Raisin Bank's Interest Rate Tracker

What is the Raisin Bank Interest Rate Tracker?

Raisin Bank regularly analyses retail and corporate interest rates from banks across the European Economic Area (EEA) as well as the data of the European Central Bank (ECB). In the Interest Rate Tracker you will find a comparison of each market’s top available interest rates with the rates at their respective largest banks; the spread between top 1- and 3-year rates; and a comment on the latest ECB data for retail and corporate interest rates across Europe. The newest edition is below.

Banks offer little relief as financial squeeze tightens its grip around savers

Savers, marred by growing inflation and geopolitical uncertainty, need their cash to work harder than ever. However, banks offer little relief as the threat to consumers’ savings grows.

Across Europe, savers are saving at a much slower pace than they were before the pandemic. As inflation tightens its grip around their wallets, however, little relief is to be found at banks on the high street. A growing number of big banks across the continent are taking interest-bearing products off their shelves, or offer negative interest rates to their customers. While interest rates have nominally risen across Europe, most banks are offering products with rates just over a tenth of a percent.

“The cost of living has risen steeply across the continent, with the 3 largest economies averaging at a remarkable 6% in March 2022,” says Katharina Lüth, Managing Director at Raisin.

“As the Fed and Bank of England have introduced interest rate hikes, economists expect that they will also increase by a hair across Europe in the coming months. Therefore, now more than ever, it is important for European savers to start taking a more active role in searching for the most attractive savings products on the market, both to make their money work harder for them in the meantime, and to be prepared when these policy changes come into effect.”

Indeed, many savers are currently not taking up opportunities to curb the impact of inflation on their ability to save. In the UK, where the bank rate has successively risen over the past months, “nearly a quarter of the nation’s savings were parked in zero- or low-interest bearing accounts, such as current accounts,” according to Kevin Mountford, CEO and co-founder of Raisin UK.

As governments and financial institutions traverse a post-pandemic environment, it will be useful for savers to educate themselves on upcoming policy shifts, as well as which new offers are available in the savings and investments space.

Austrian organizations join community of big banks that do not offer interest rates on 1-year fixed term deposits

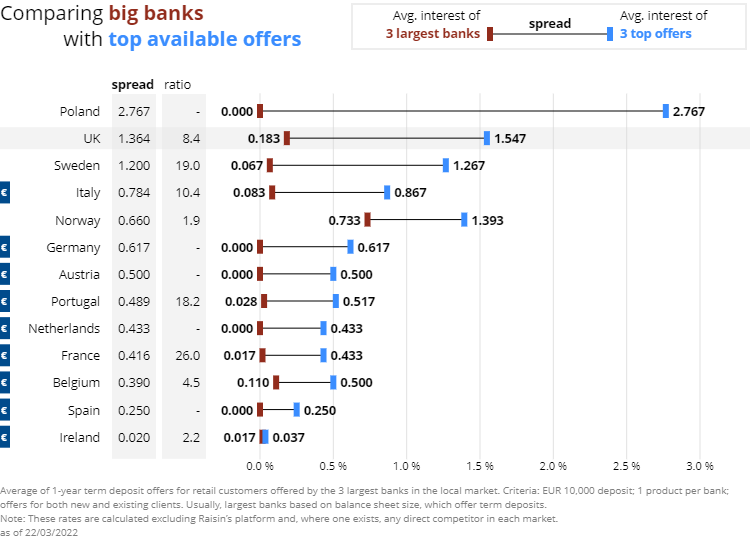

Interest rates across Europe are just as heterogeneous as its deposit markets, with offers varying strongly from market to market.

- Austria joined a growing list of countries where top banks do not offer 1-year fixed-term deposits. Top banks from Germany, the Netherlands, Spain, and Poland also do not offer their customers the ability to earn a yield on their savings.* (The lack of an offer at those banks is represented here as 0%.)

- Most of the rest of Europe offered over a tenth of one percent (<0.1%) at the big banks by the end of 2021. In the UK and Belgium, rates are slightly higher than the rest of the pack.

- Norway’s biggest banks are the stand-out with an average 1-year interest rate on fixed-term deposits of 0.733%, up one-tenth from December.

- The best available rates on the market, by contrast, are 0.3 points to 2.7 percentage points higher, excepting Ireland where there’s barely a difference.

- The top rates in Austria, Germany, Norway, Sweden, Italy, the UK, and Poland, in particular, are at least 0.5 percentage points higher than those at each market’s biggest banks.

Notes: Some of the selected big banks offer neither a 1-year term deposit nor an account with an interest bonus after 365 days without withdrawal. Their interest rate is set at 0.0% for the calculation to represent the lack of an offer. In markets where we have only found two offers for 1-year term deposits, in total, the average is calculated with just those two values.

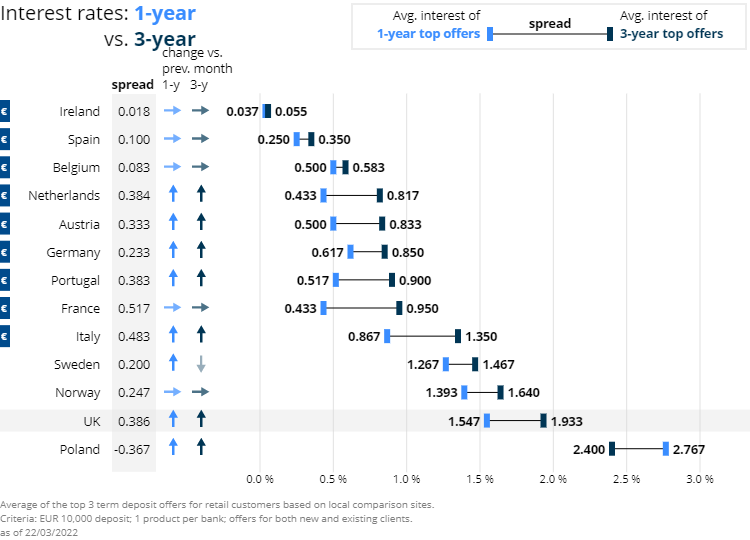

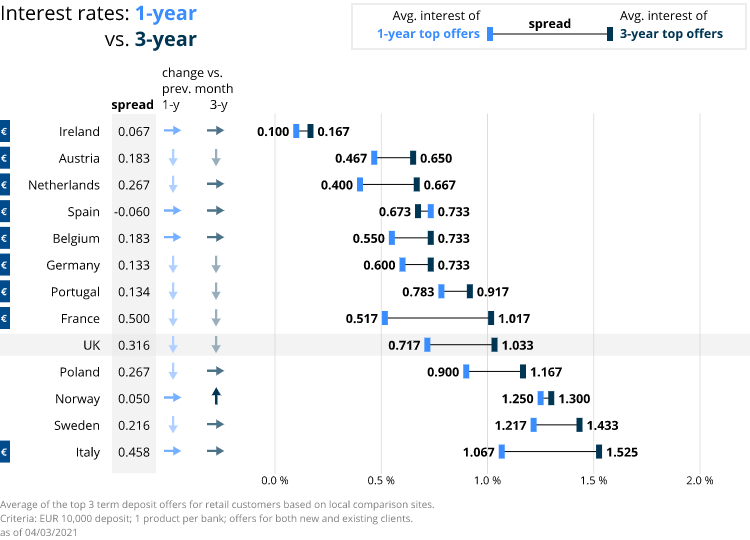

Comparing top rates: Spreads between top 1- and 3-year offers continue to widen in most countries

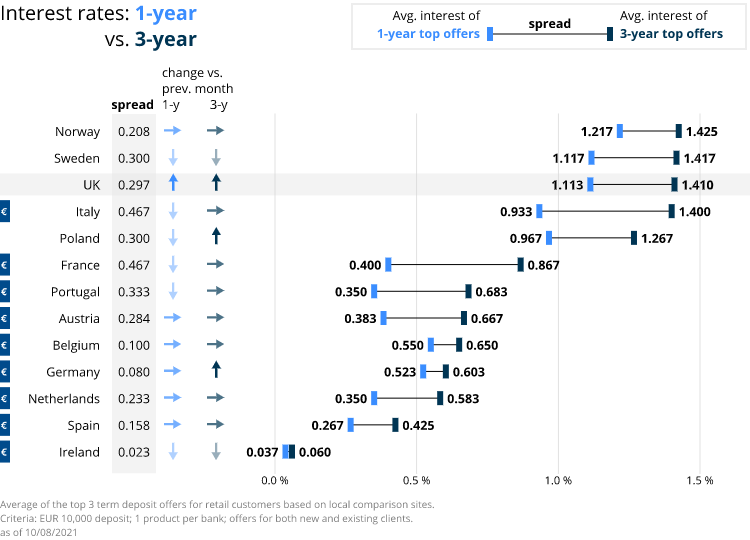

In most European markets, interest rates have nominally increased for both 1-year and 3-year deposit products compared to the previous month.

- Interest rates have grown for both 1- and 3-year deposit offers in Austria, Germany, Italy, the Netherlands, Portugal, Poland and the UK. This is after German and Italian, in particular, savers experienced a fall in rates in December 2021.

- Throughout the rest of the continent, however, rates have remained the same compared to the previous month, with the exception of Sweden, where top 1 year-rates rose and 3-year rates fell.

- Only in Poland are 3-year rates better than those on 1-year fixed-term products.

- Italy, Sweden, Norway, Poland and the UK are the only countries where the top 3-year rates exceed 1.0%.

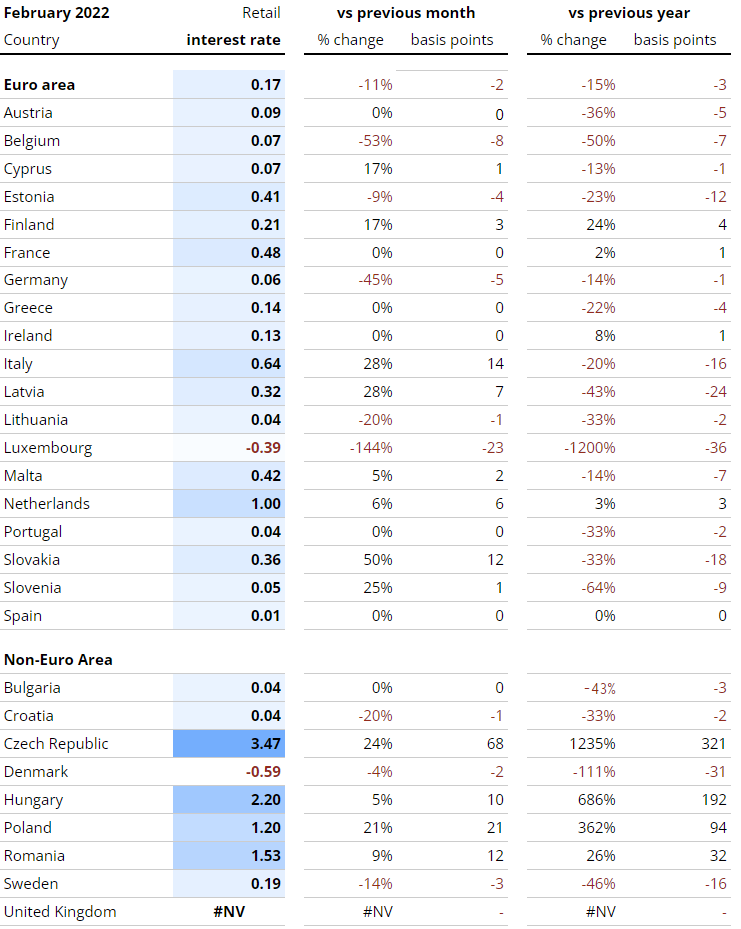

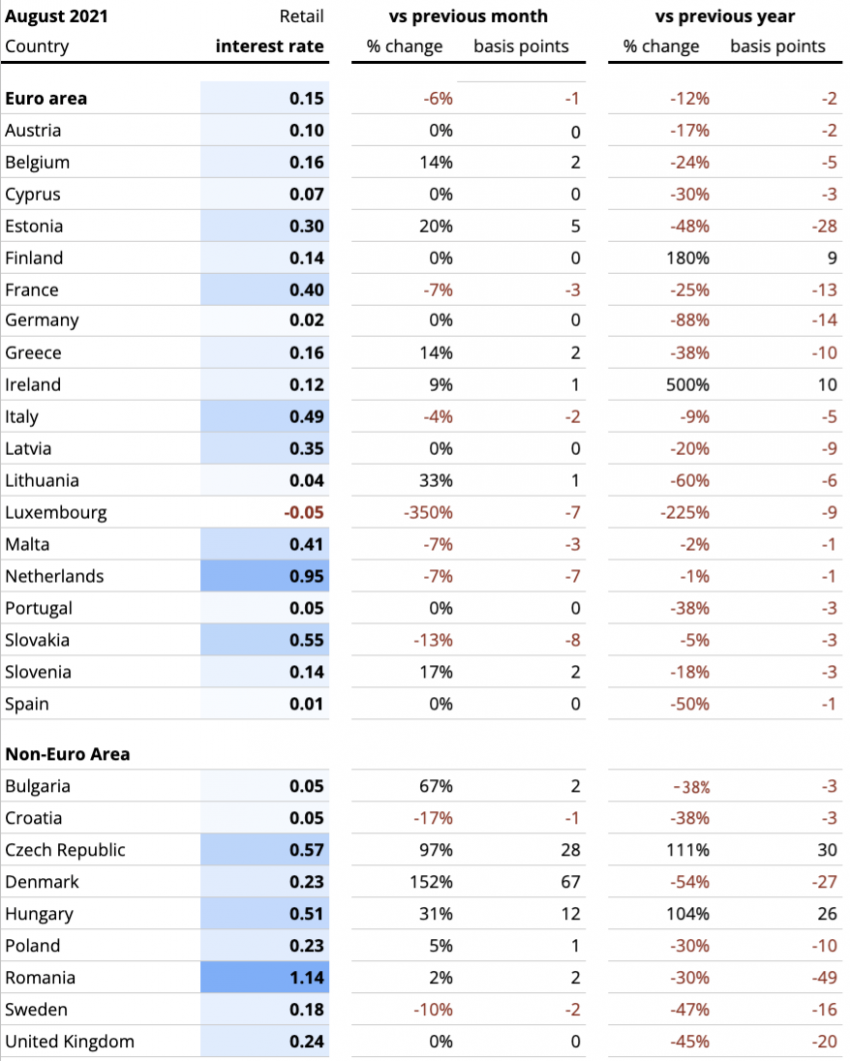

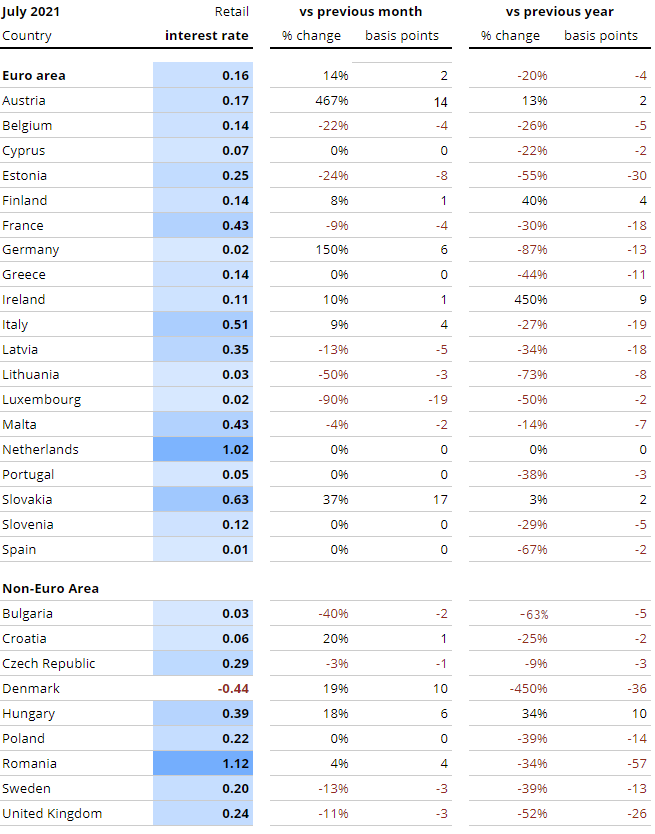

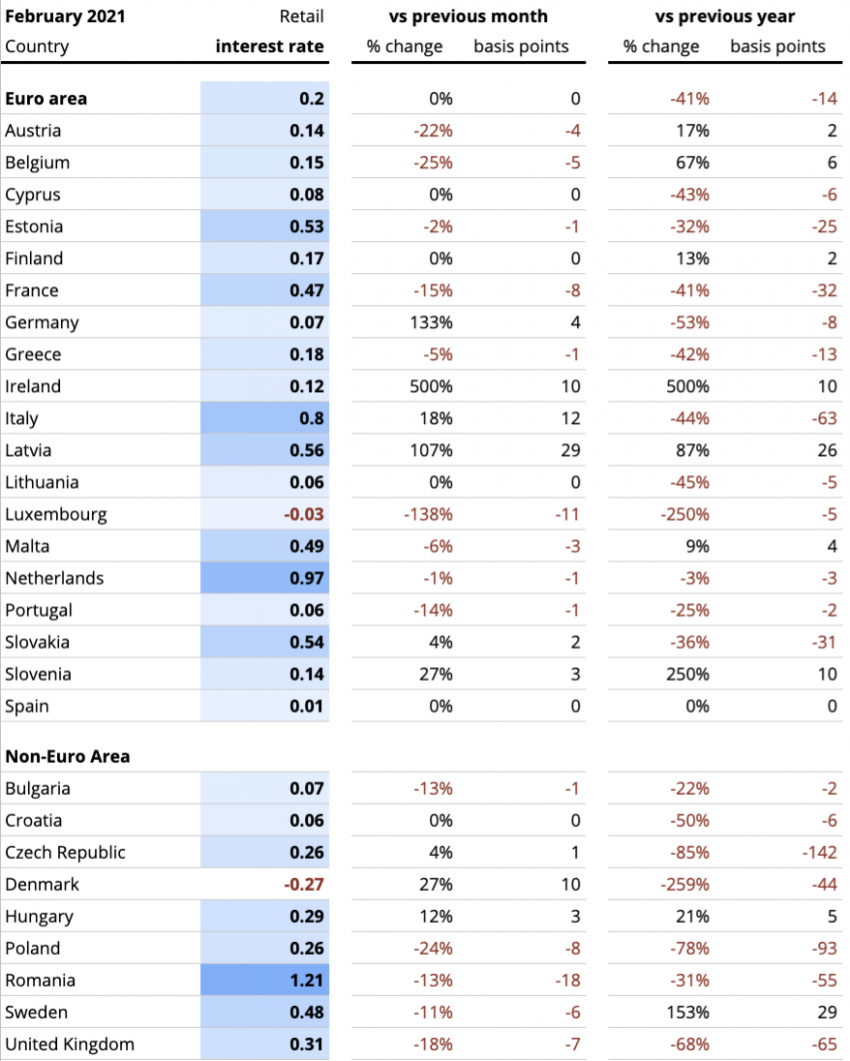

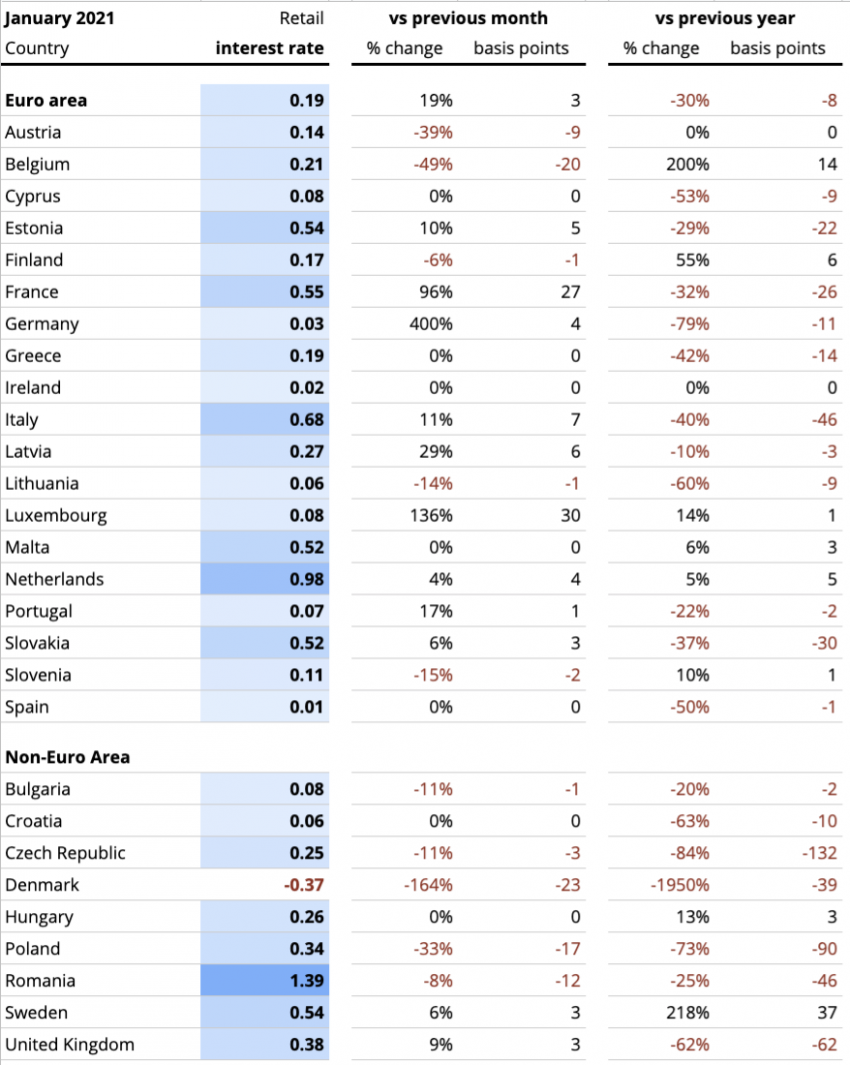

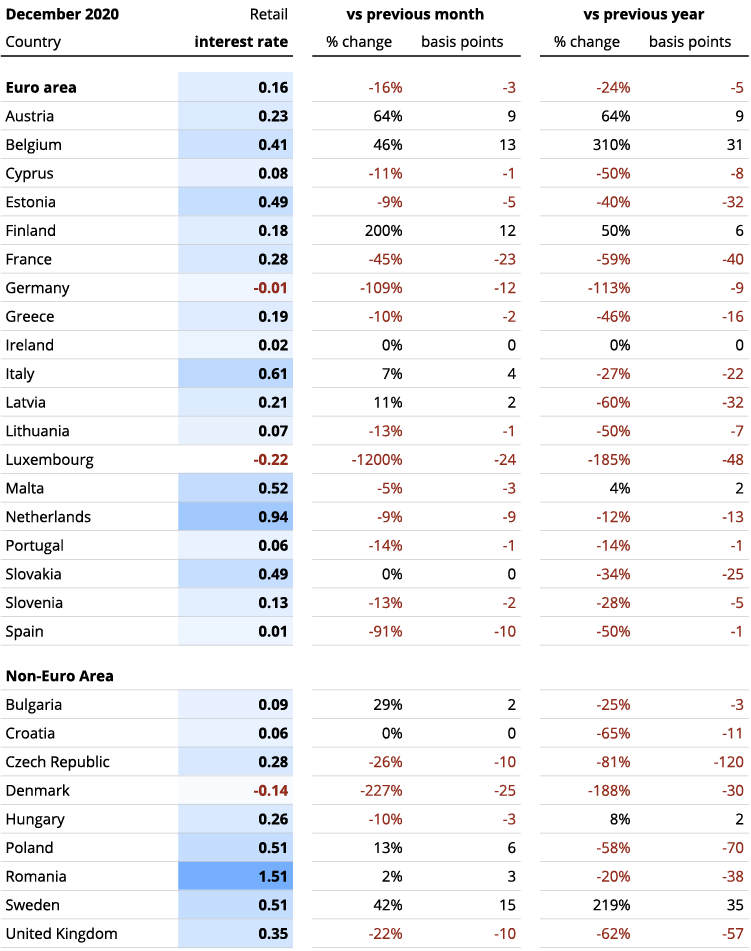

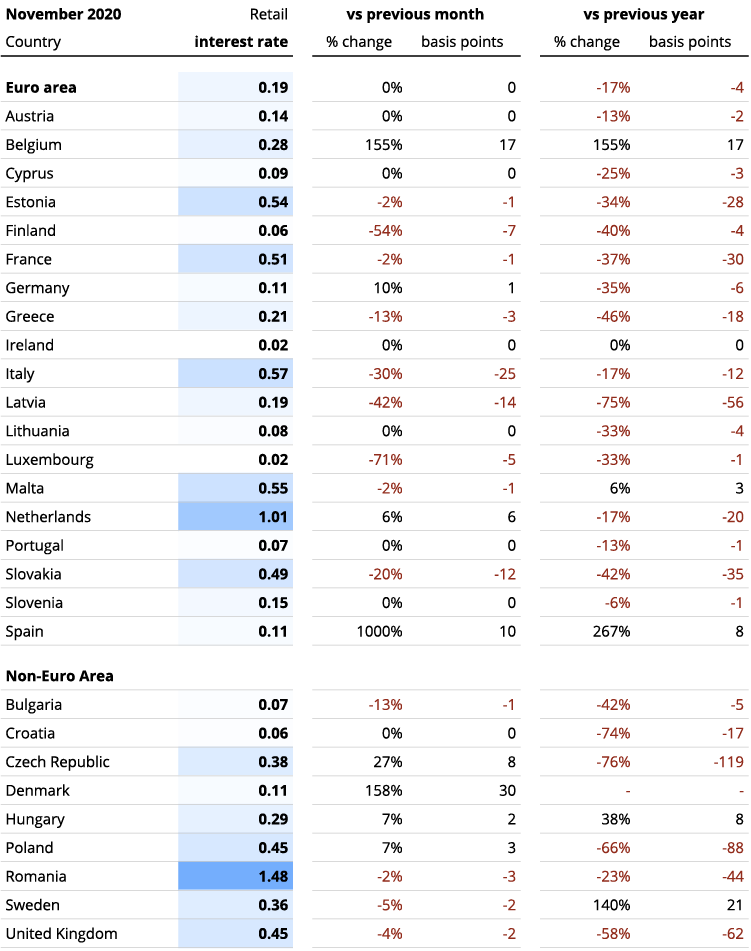

ECB data analysis: Retail rates trended downward inside the eurozone but remained largely unchanged in the rest of Europe

At 0.17%, retail rates increased by 2 basis points compared to January 2021 in the eurozone.

- Compared to January, retail rates fell in Belgium, Estonia, Germany and Luxembourg, but still remain positive.

- In Luxembourg in particular, retail rates fell down by 144%, driving the rate to -0.39%.

- Outside the euro-area, retail rates generally trended upwards compared to January, with the exception of Croatia, Denmark and Sweden.

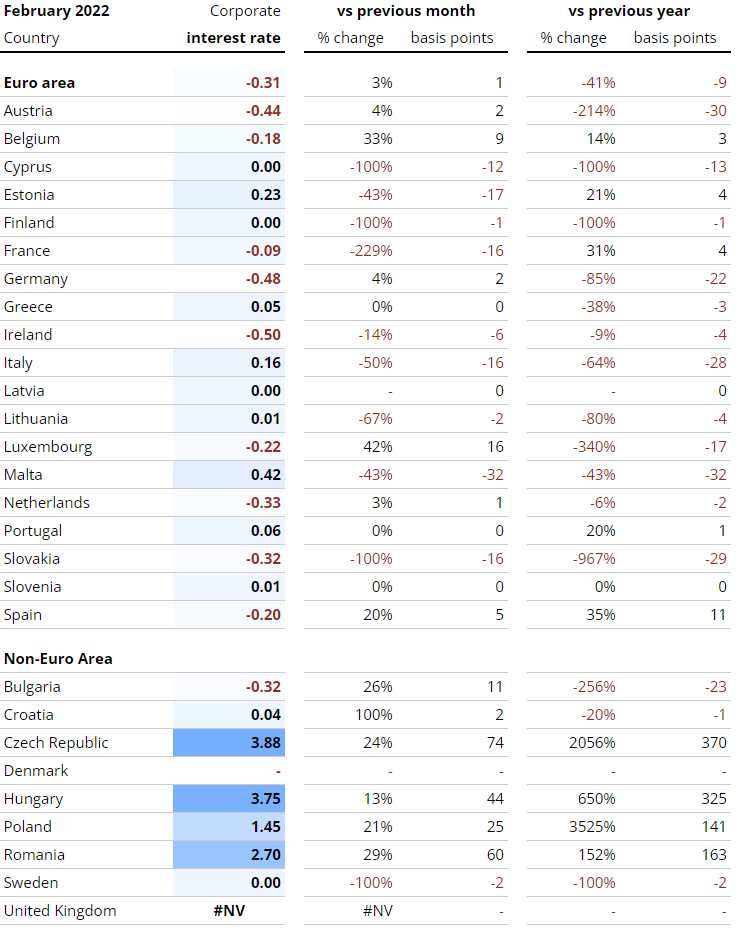

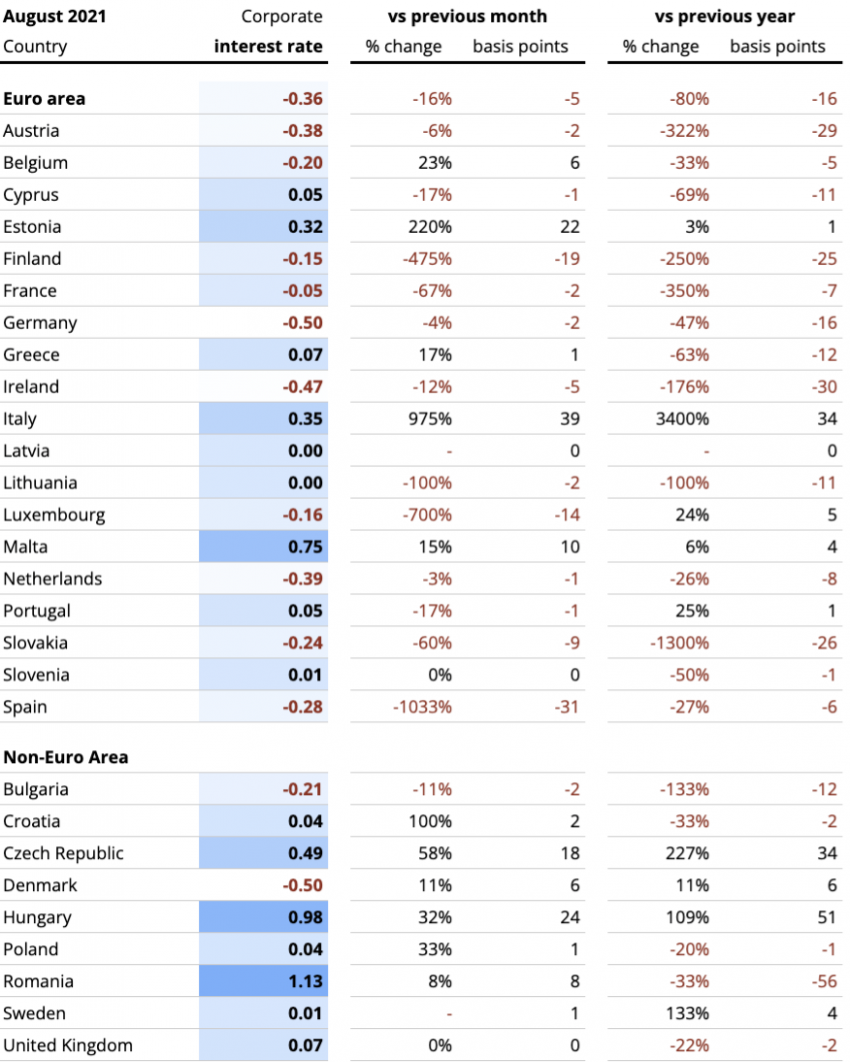

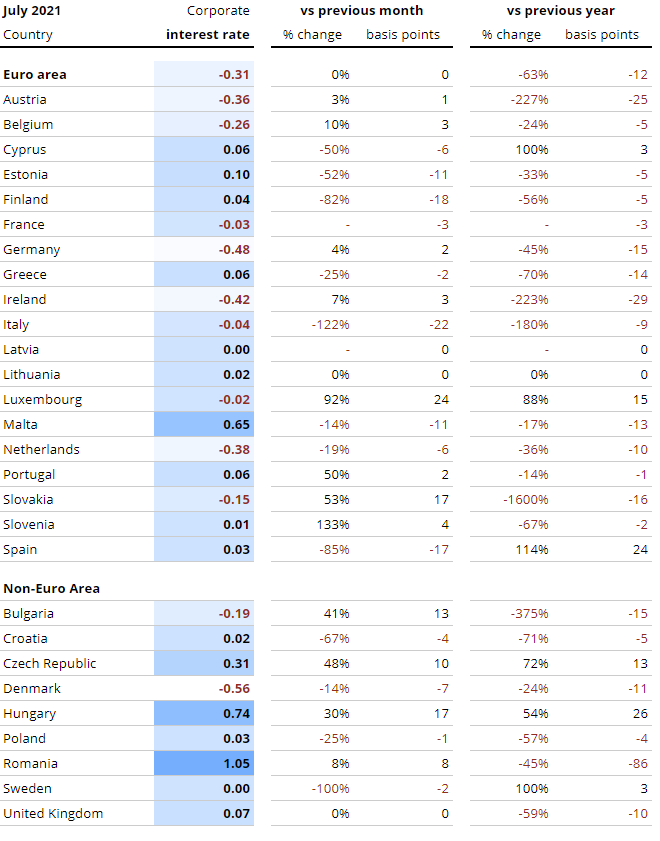

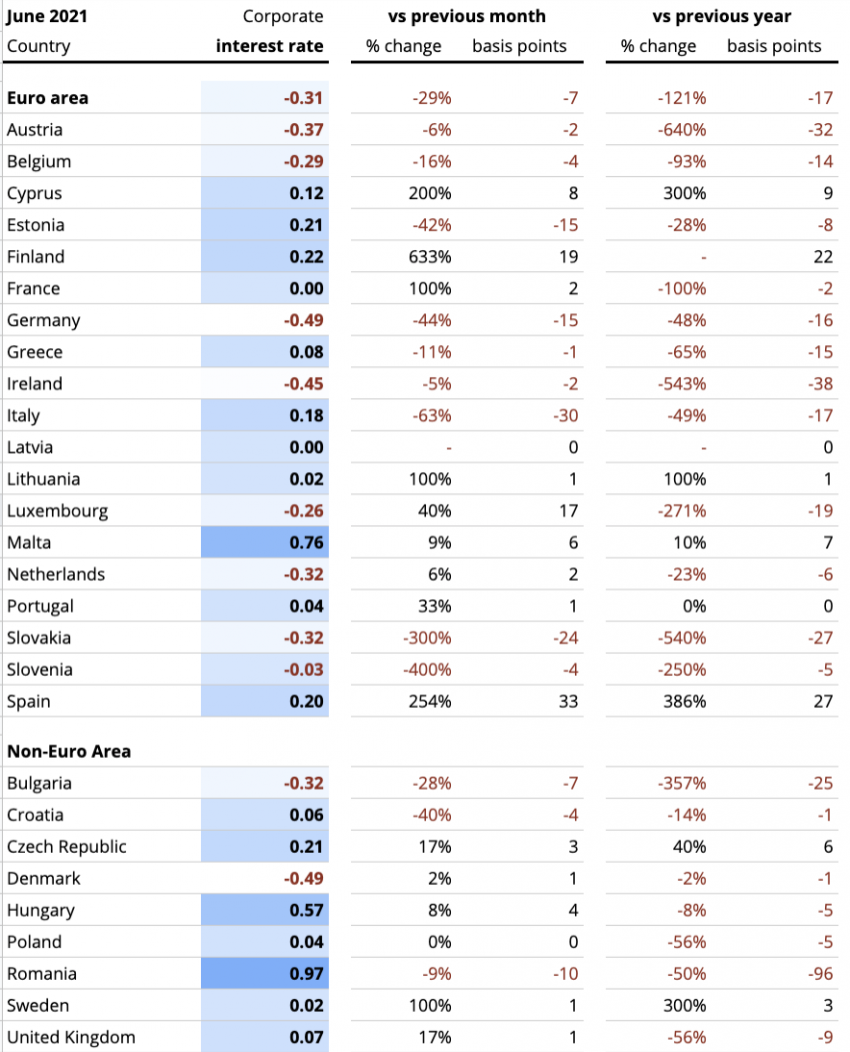

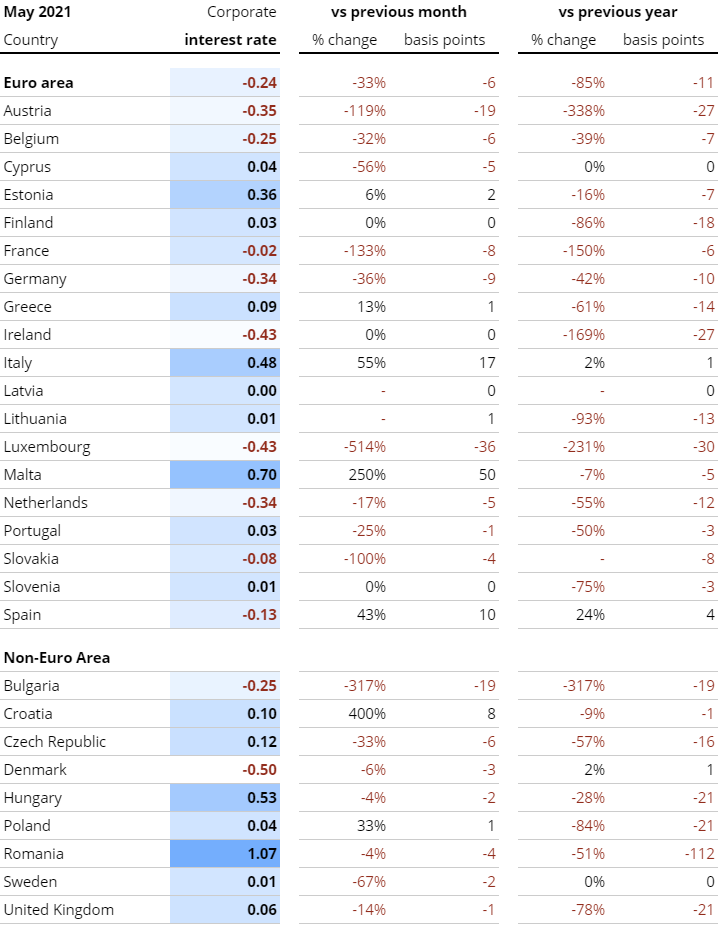

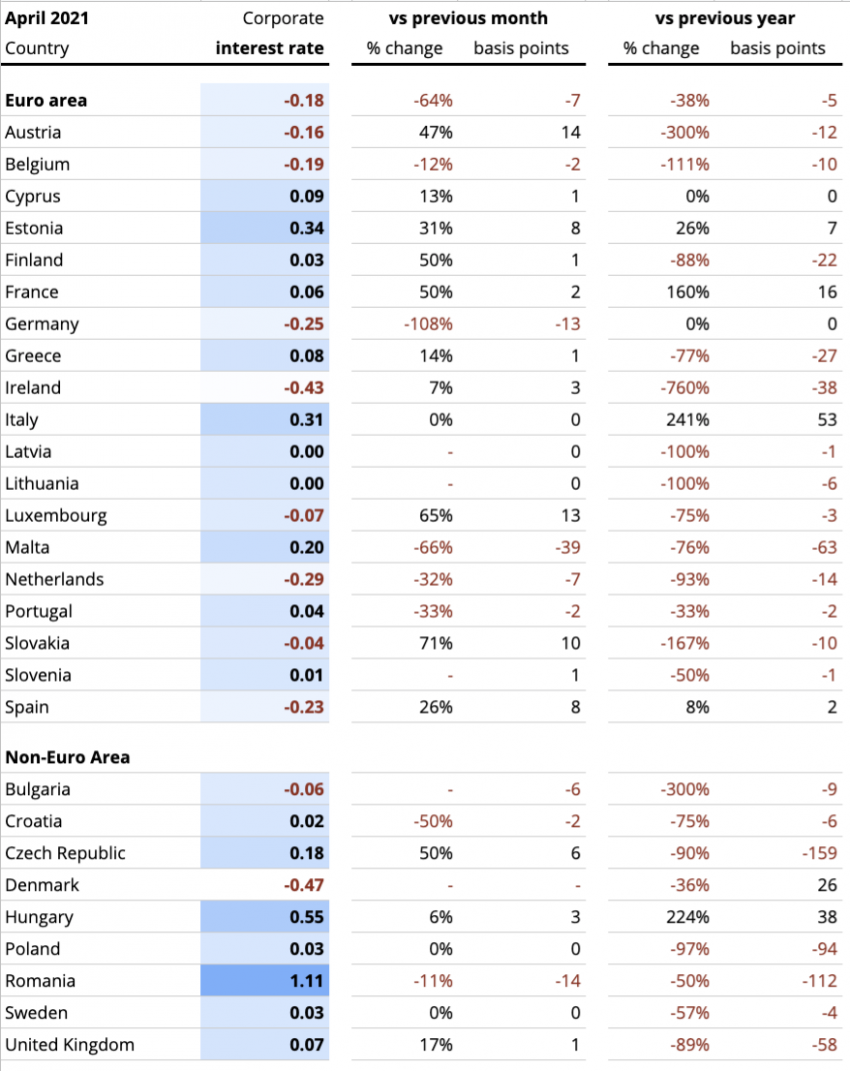

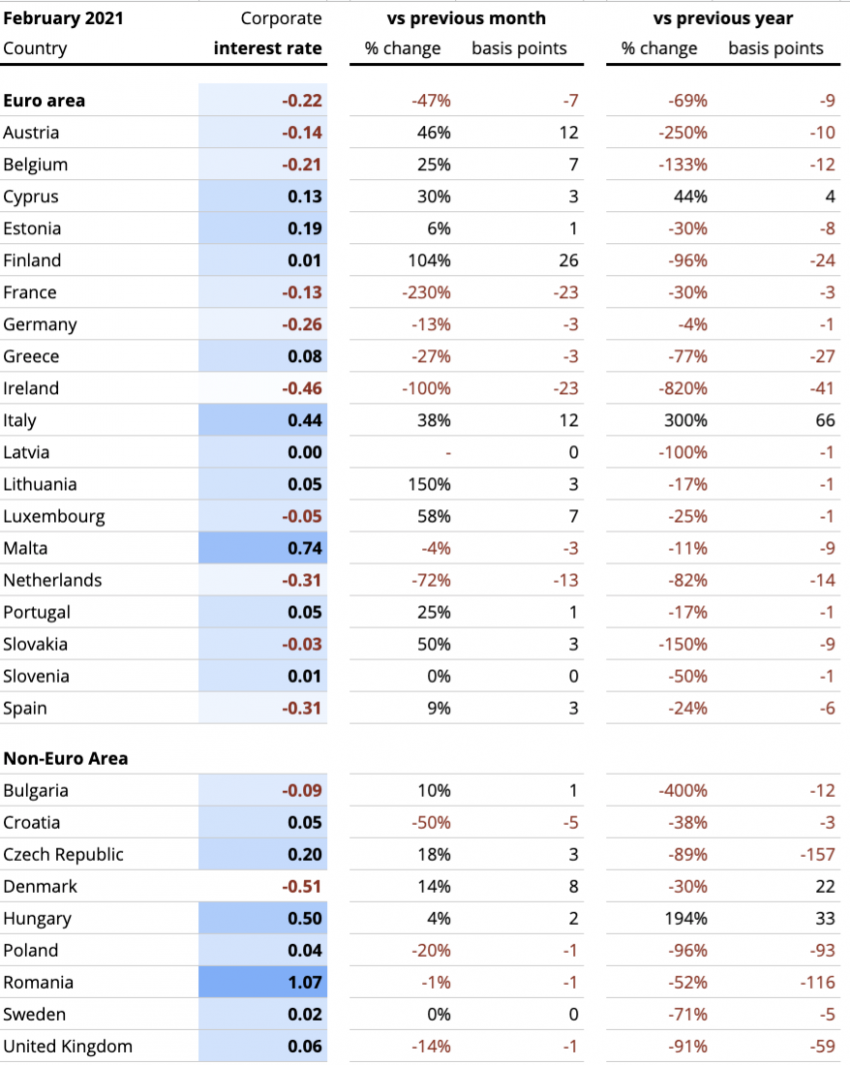

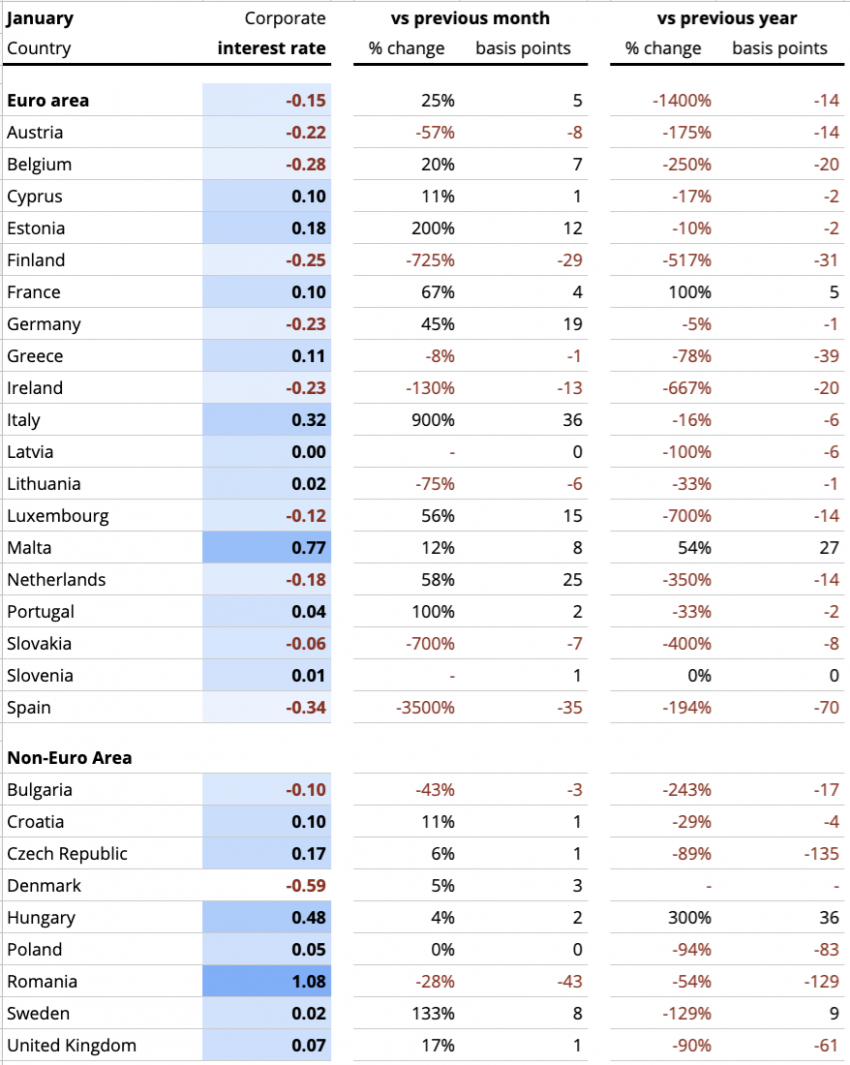

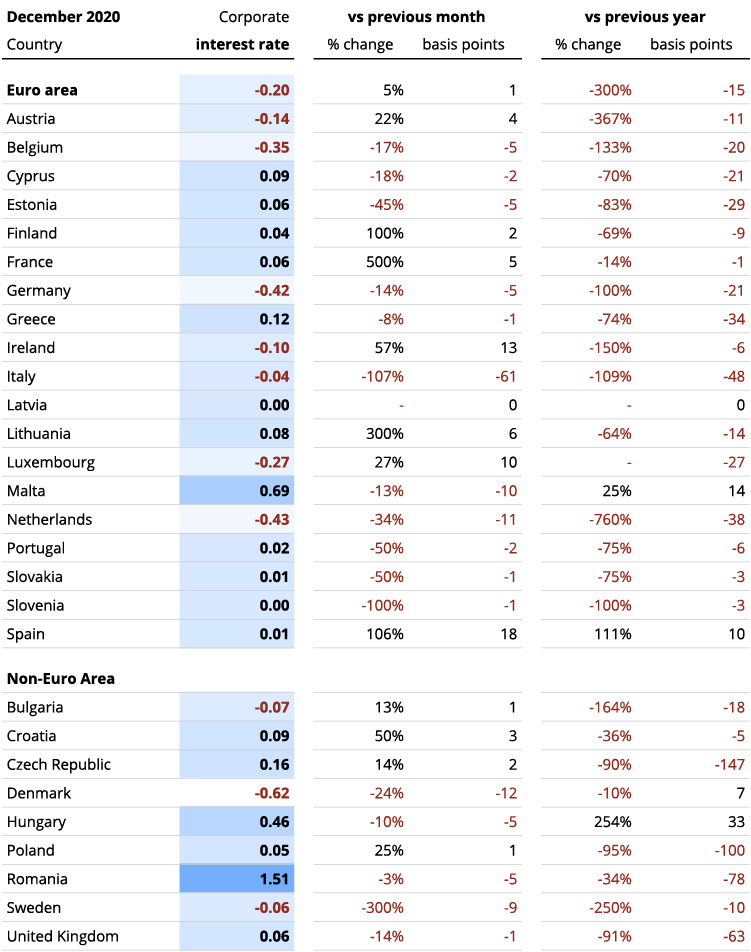

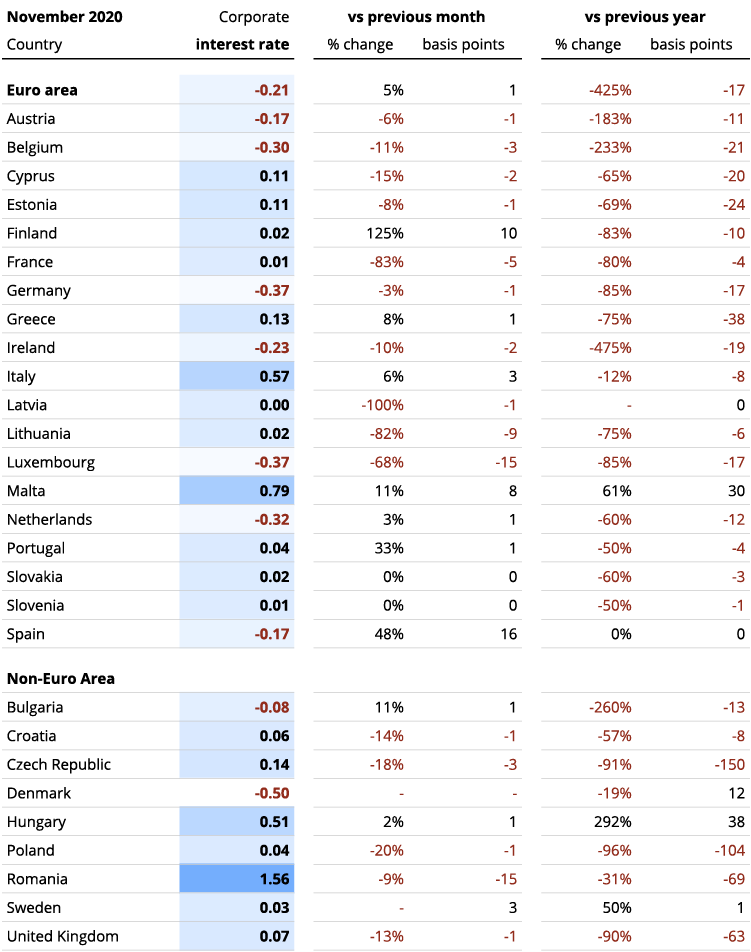

ECB data analysis: In the euro-area, corporate rates remain in the red, with rates as low as -0.50% and -0.48% in Ireland and Germany respectively

- Austria, Belgium, France, Germany, Ireland, Luxembourg, Slovakia and Spain all charge negative rates, ranging from -0.50% to -0.09%.

- Outside the euro-area, only Bulgaria charges negative interest rates for corporate clients – the rest either offer positive or no interest rates.

Sources

Raisin, ECB

For top bank offers:

Austria: Erste Bank, Raiffeisenlandesbank Oberösterreich, Bawag – sparzinsen-vergleich.at/

Belgium: ING Belgium, KBC, Belfius Bank – spaargids.be

France: BNP Paribas, Credit Mutuel, Societe Generale – francetransactions

Germany: Deutsche Bank, Commerzbank, HypoVereinsbank – biallo.de

Ireland: Bank of Ireland, Allied Irish Banks, Ulster Bank – ccpc.ie

Italy: UniCredit, Banca Monte dei Paschi di Siena, Mediobanca – confrontaconti.it

Netherlands: RaboBank, ING, ABN – geld.nl, spaarrente.nl

Norway: DNB, Danske, Nordea – finansportalen.no

Poland: PKO Bank Polski, Bank Pekao, mBank – oprocentowanie.pl

Portugal: Novo Banco, BPI, BCP – comparaja.pt

Spain: Santander, BBVA, Caixabank – tucapital.es

Sweden: Nordea, SEB, Svenska Handelsbanken – finansportalen.se

United Kingdom: HSBC, Barclays, RBS – which.co.uk

The year that transformed savings?

2021 saw big banks look for an exit as Europeans kept stashing their cash

Banks charge fees, offer negative interest rates, and pull fixed-term deposit products altogether. But consumers just deposit more money, creating “systemic bottleneck.”

Flooded with Europeans’ pandemic savings, along with government or central bank stimulus money, in 2021 most of the biggest European banks stopped offering fixed-term deposits. Certainly, it became nearly impossible for retail banking customers to find the most popular products, 6-month, 1-year, and 2-year deposits at the continent’s largest institutions – not to mention overnight accounts.

But Europeans are saving nonetheless. They saved on average more than they spent every month between September 2019 and August 2021. The most recent European Central Bank data show that, after a brief spending splurge at the end of summer, consumers across Europe for the most part went back to saving: in October savings inflows increased from the prior month 65% in Spain, 160% in Belgium, 223% in Germany, and 760% in Italy.

Of the eurozone’s major economies, only France saw more October spending than saving (having previously also been the exception, continuing to save through August while the rest of Europe spent more).

Covid-19 bolstered Europeans love of saving, but they could do it more strategically

With fewer opportunities to earn a yield on their savings at the bank, consumers may choose to hold onto cash for other reasons, as financial expert Andreas Wiethölter explains:

“Even in a low rate environment, savings play an integral role in people’s financial security. Deposits are the one asset class where customers have a guarantee on their principal. When smartly diversified, they offer a higher level of flexibility than most investments. The pandemic demonstrated that we need to be prepared for a degree of volatility and for the unexpected more generally, which includes being able to access some of our money.”

Wiethölter expands, below in the Comment, on two common mistakes Europeans are making with their savings and how more strategic saving could ease pressure on banks as well.

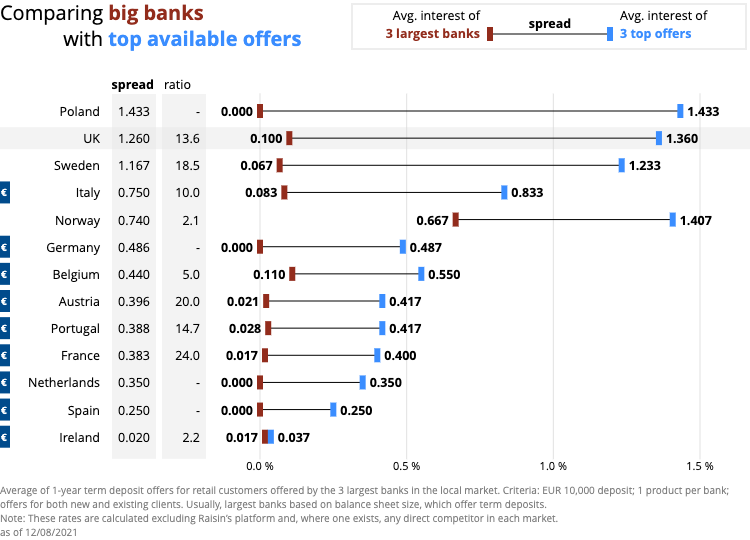

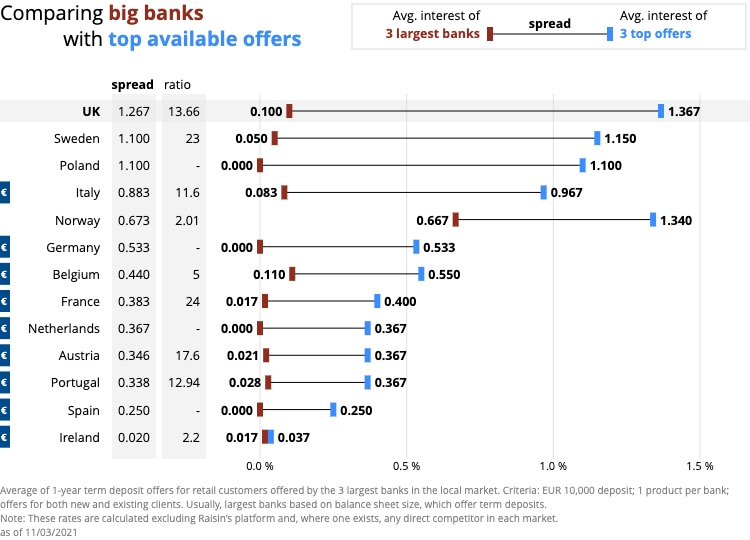

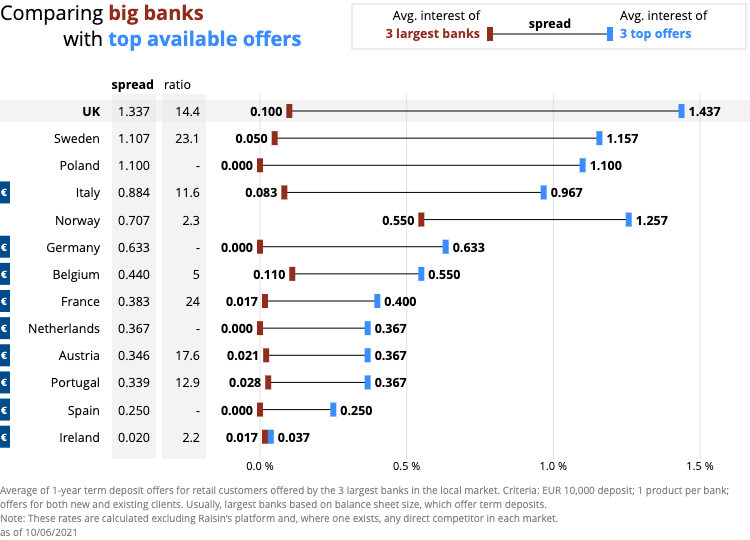

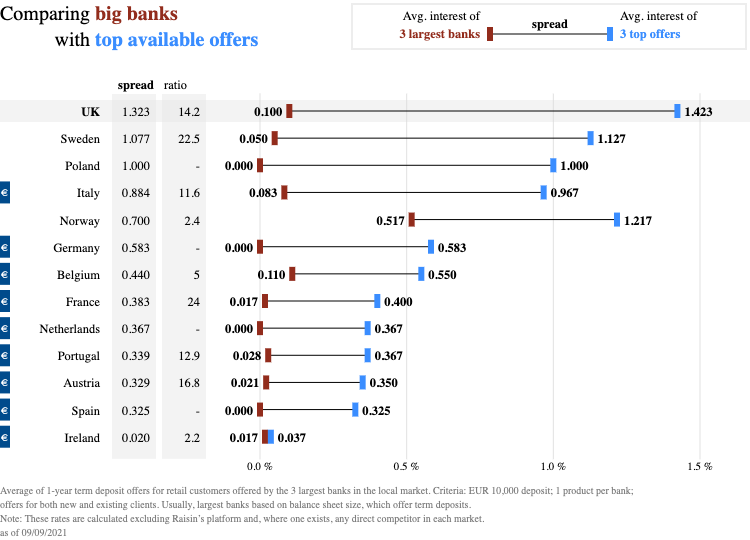

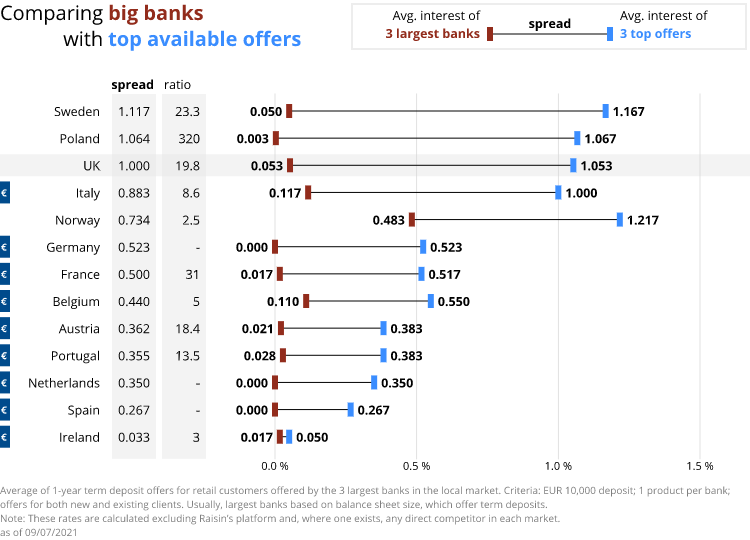

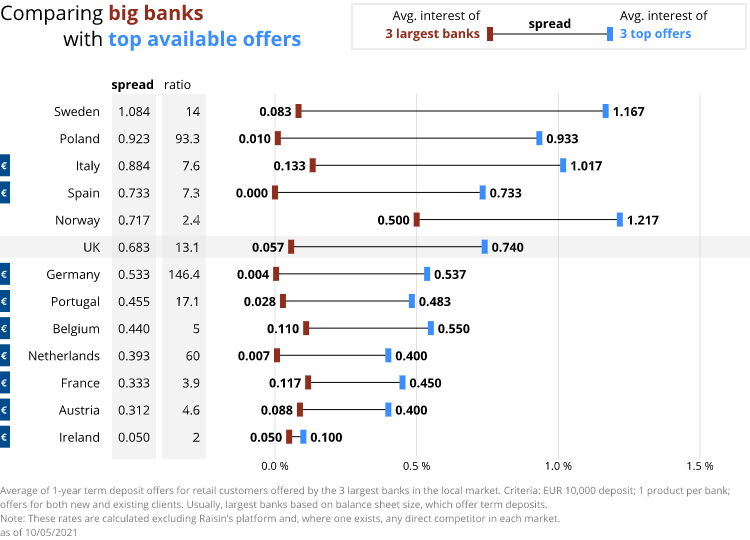

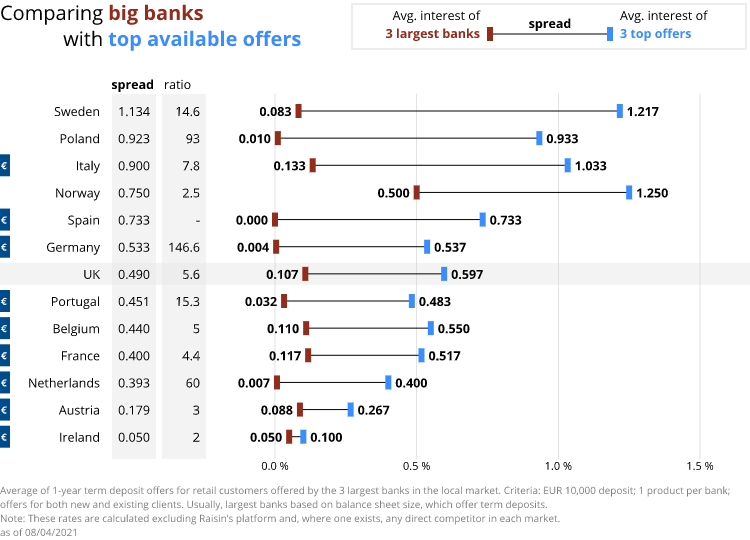

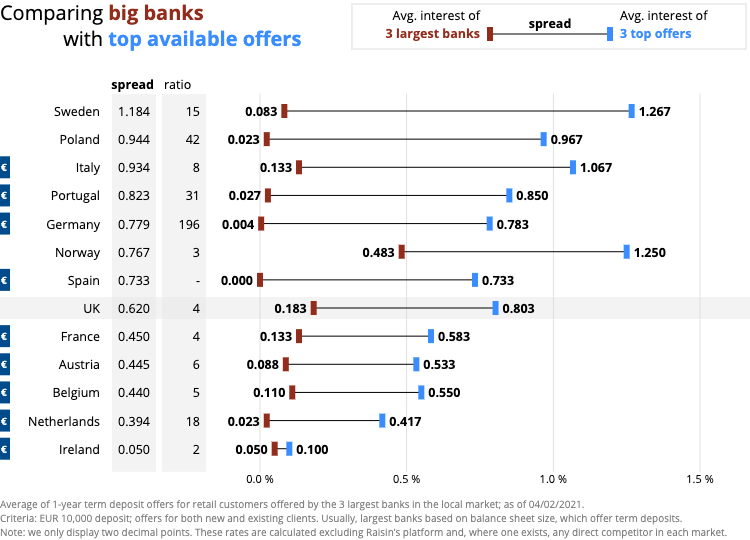

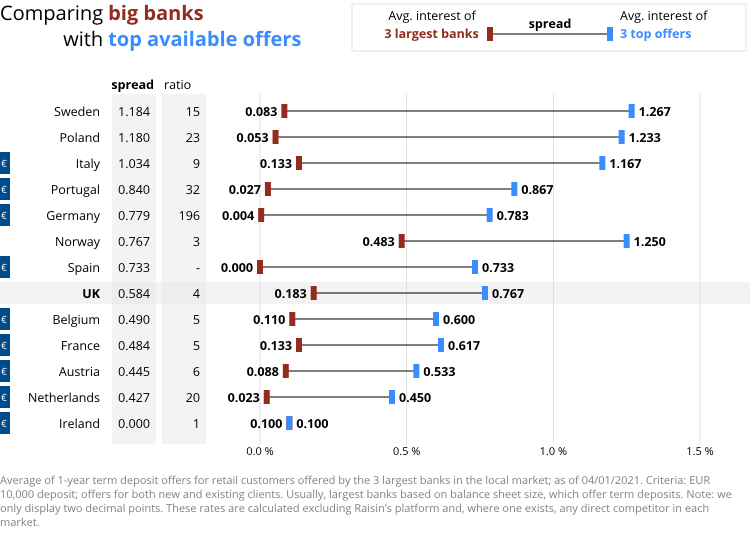

The interest rate spread: Best offers vary across Europe from 0.04% to 1.43%

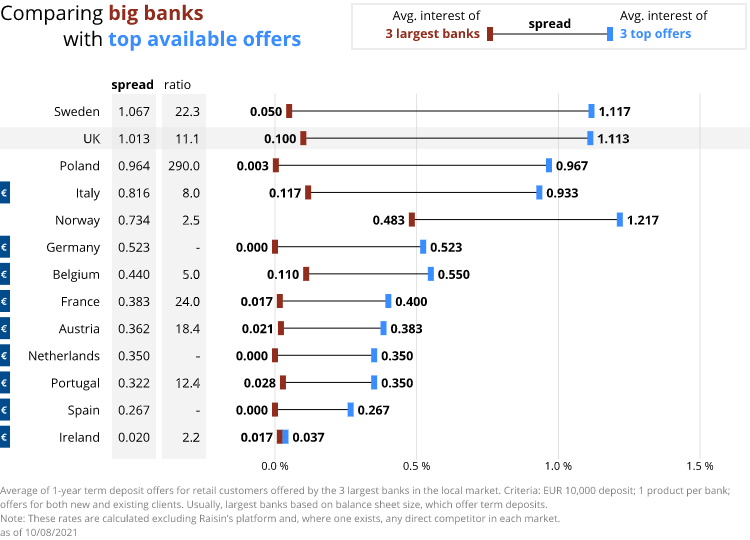

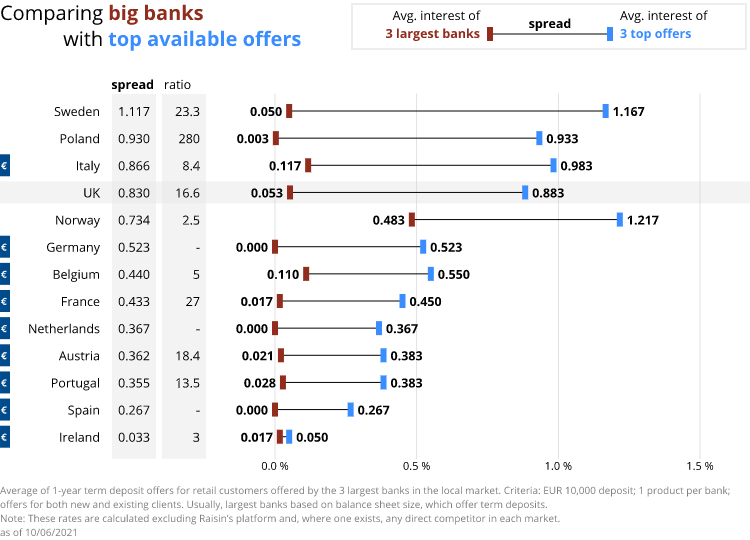

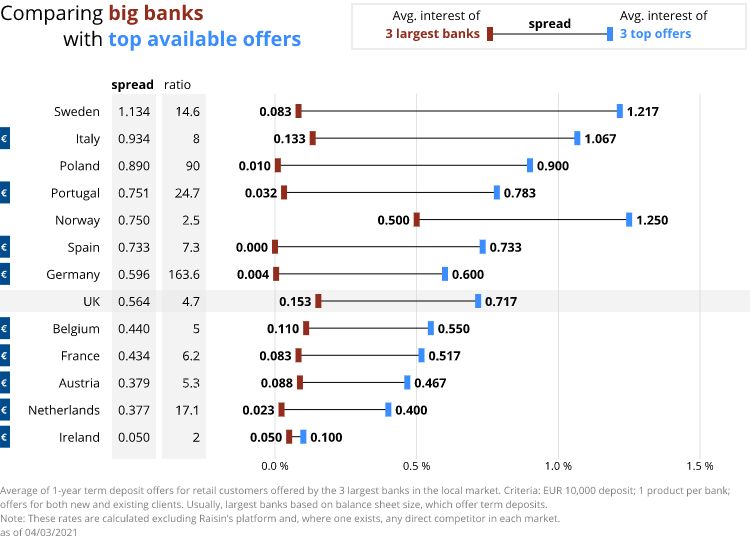

Europeans can expect very different interest rates depending on whether they turn to their high street banks or alternative providers with higher rates, and to an even greater extent depending on where they are located.

- The largest banks in Germany, the Netherlands, Spain, and Poland currently offer no direct 1-year fixed term deposits.* (The lack of an offer at those banks is represented here as 0%.)

- Most of the rest of Europe is seeing offers under a tenth of a percent (<0.1%) at the big banks, with Belgium and the UK only at or fractionally above that.

- Norway’s biggest banks are the stand-out with an average 1-year interest rate on fixed term deposits of 0.667%.

- The best available rates on the market, by contrast, are 0.2 points to 1.4 points higher, excepting Ireland where there’s barely a difference.

- The top rates in Norway, Sweden, Italy, the UK, and Poland in particular are at least 0.7 points higher than those at each market’s biggest banks.

Notes: Some of the selected big banks offer neither a 1-year term deposit nor an account with an interest bonus after 365 days without withdrawal. Their interest rate is set at 0.0% for the calculation to represent the lack of an offer. In markets where we have only found two offers for 1-year term deposits, in total, the average is calculated with just those two values.

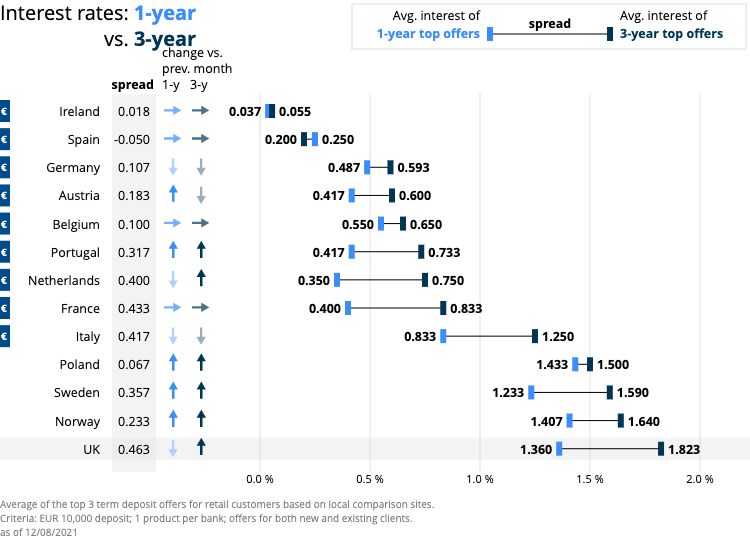

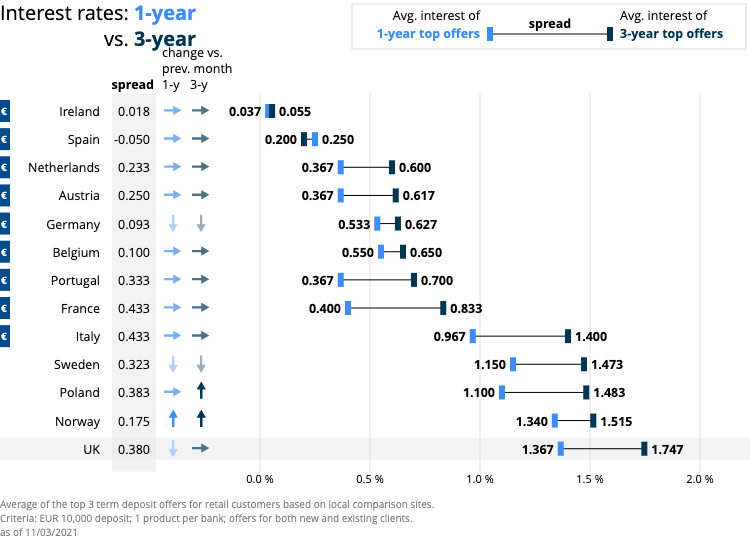

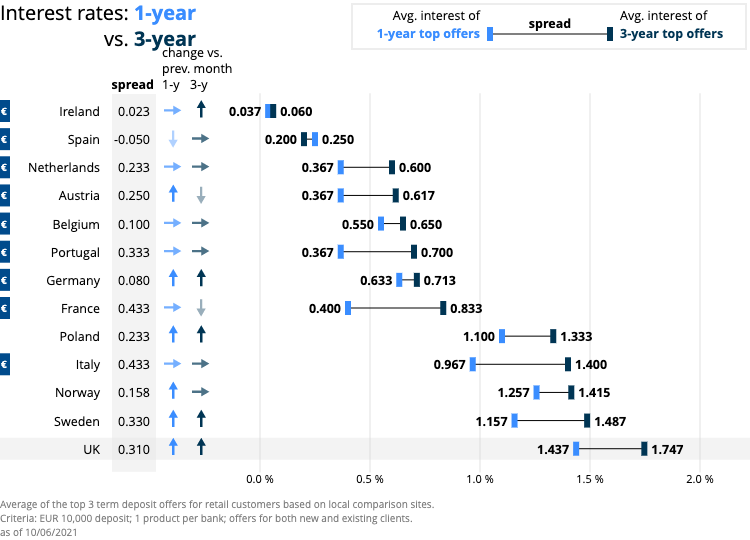

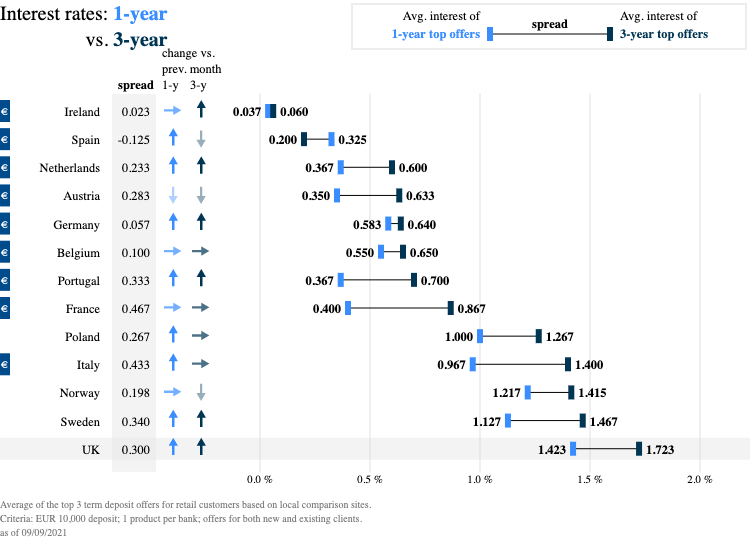

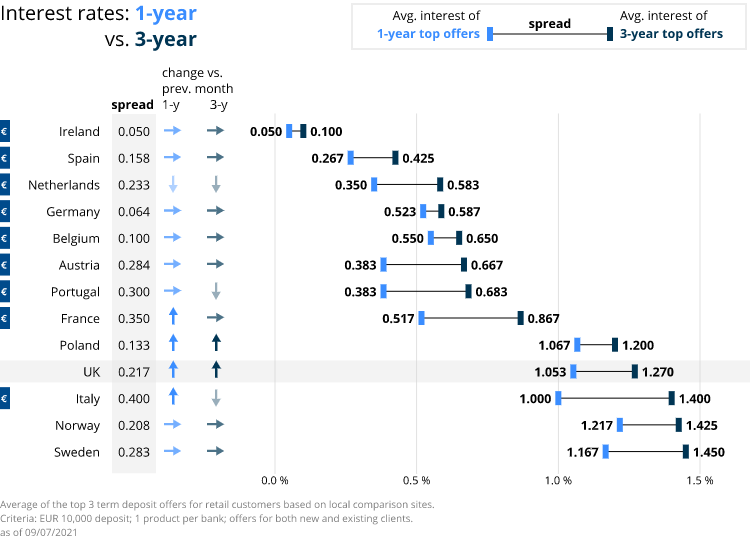

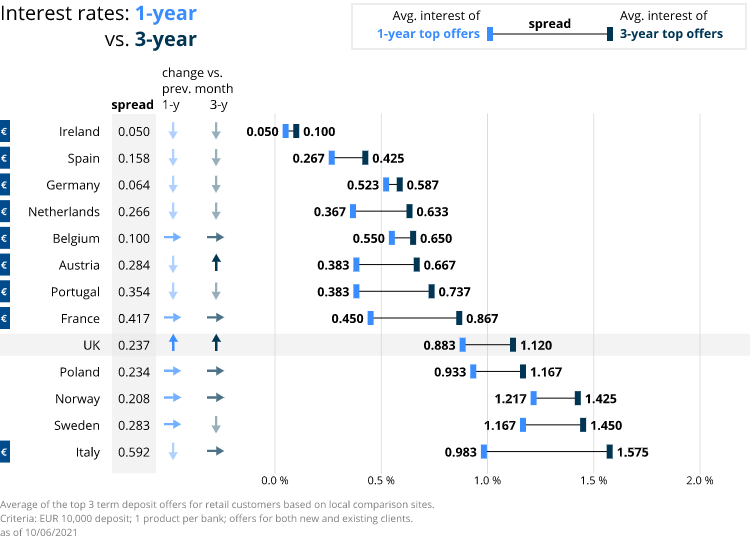

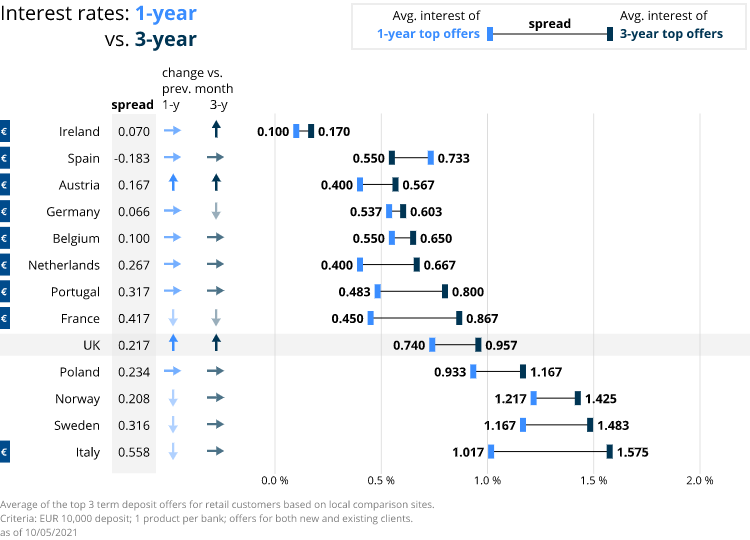

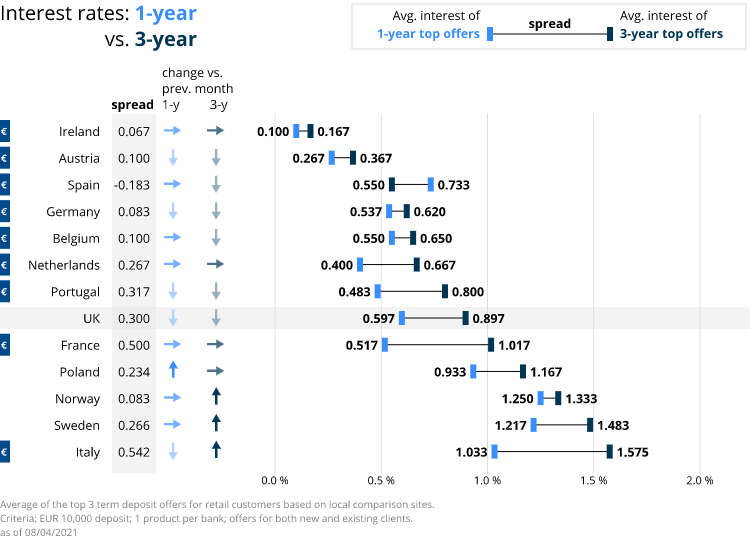

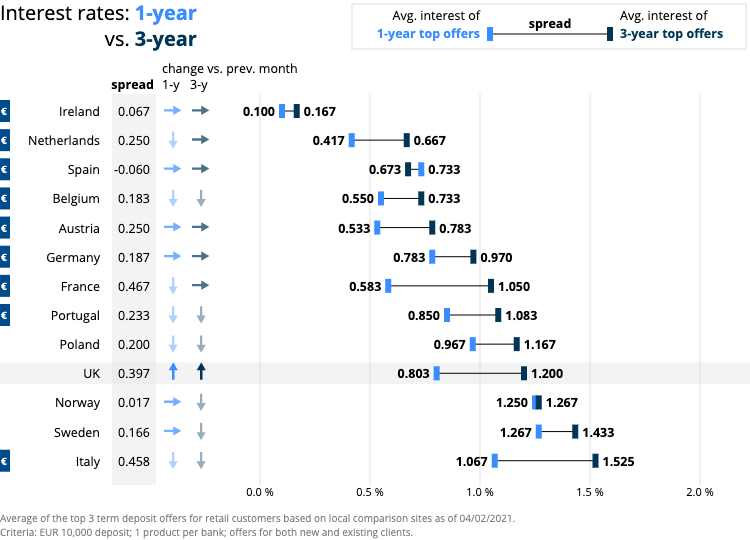

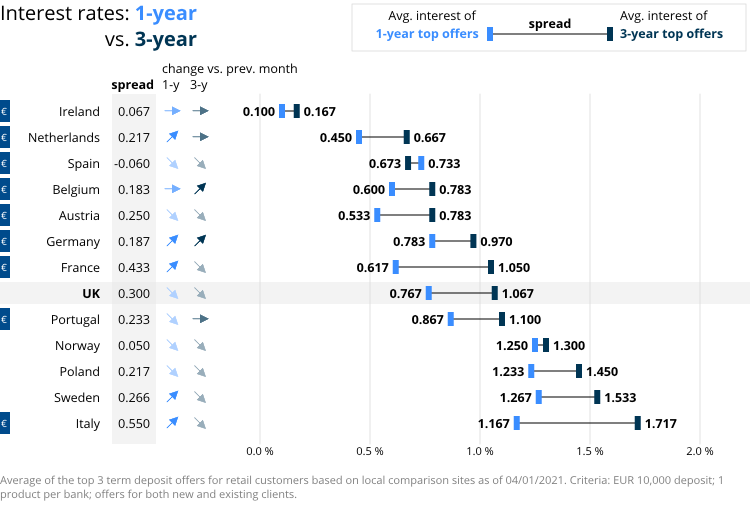

Comparing top rates: Difference between top 1-year and top 3-year interest rates under 0.5 points, Europe-wide

A new level of dynamism affected top interest rates this month, though not always to the benefit of depositors. The highest available interest rates varied widely across Europe with four markets seeing upward movement. But most of the largest economies experienced further falls or simply stagnant rates.

- Sweden and Norway, as well as Poland and Portugal, are seeing their top 1- and 3-year interest rates rise.

- The highest rates in Germany and Italy have fallen for both 1- and 3-year deposits.

- Spain’s top 1-year rates continue to be higher than top 3-year rates.

- France and Belgium joined Ireland and Spain in experiencing no change. For the latter two countries that continues to mean rock bottom interest rates.

- The Netherlands and the UK are seeing falling 1-year rates but rising 3-year interest, while Austria got the opposite, higher 1-year rates but lower 3-year.

- The UK top rates are both more than half a point higher than one year ago, the reverse of Italy, which lost half a point off its 3-year top rate.

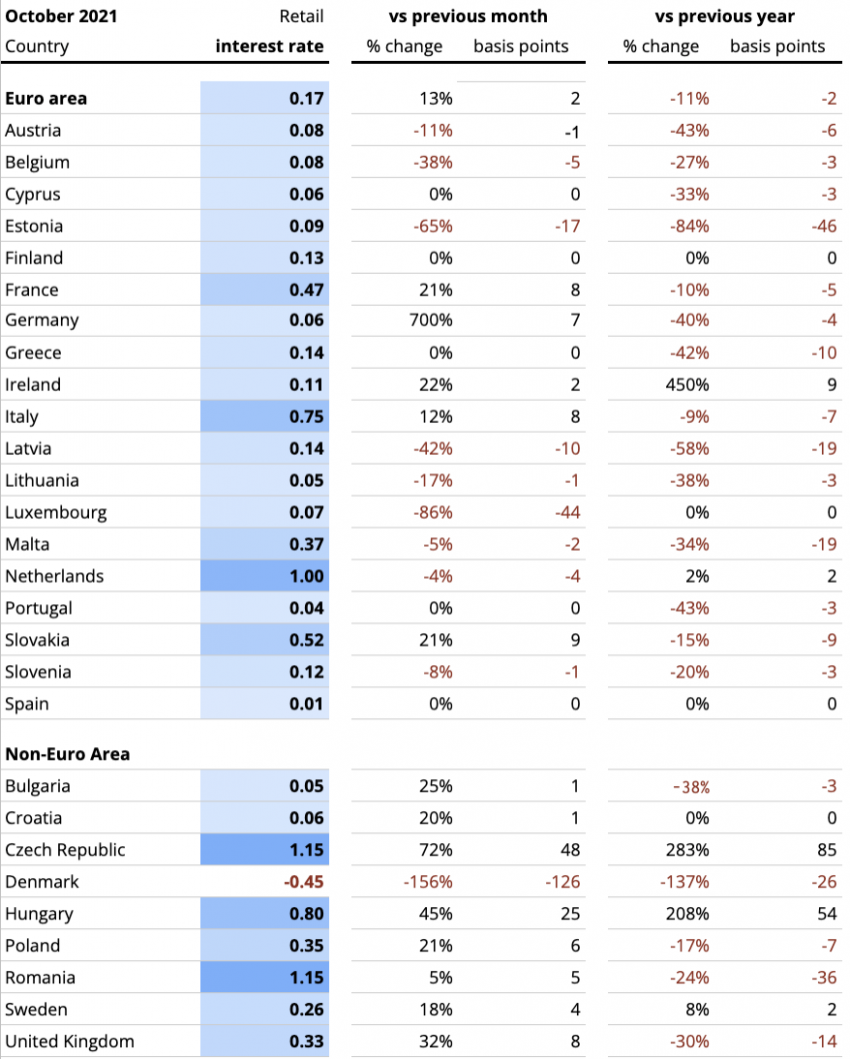

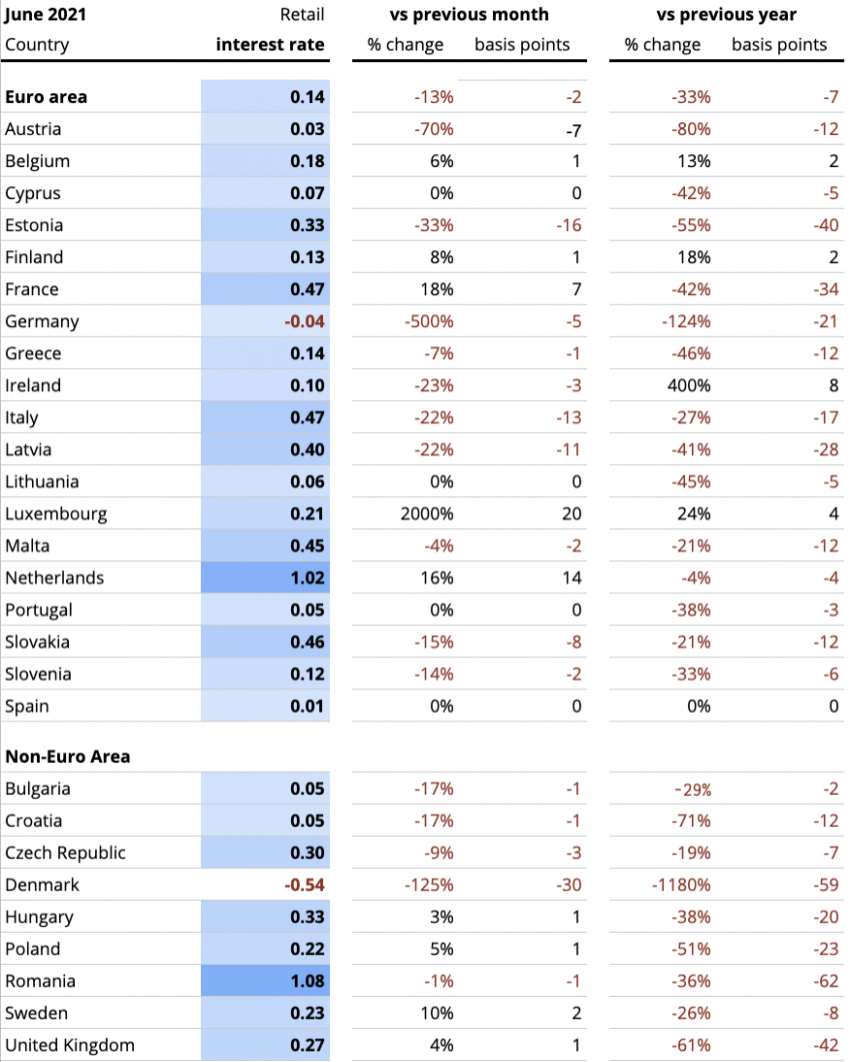

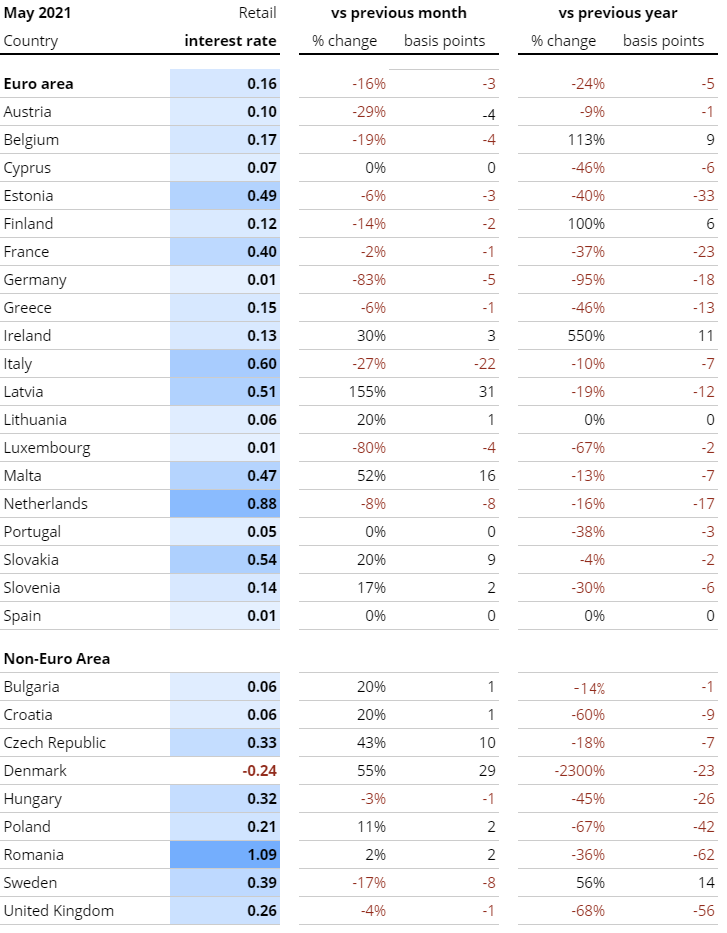

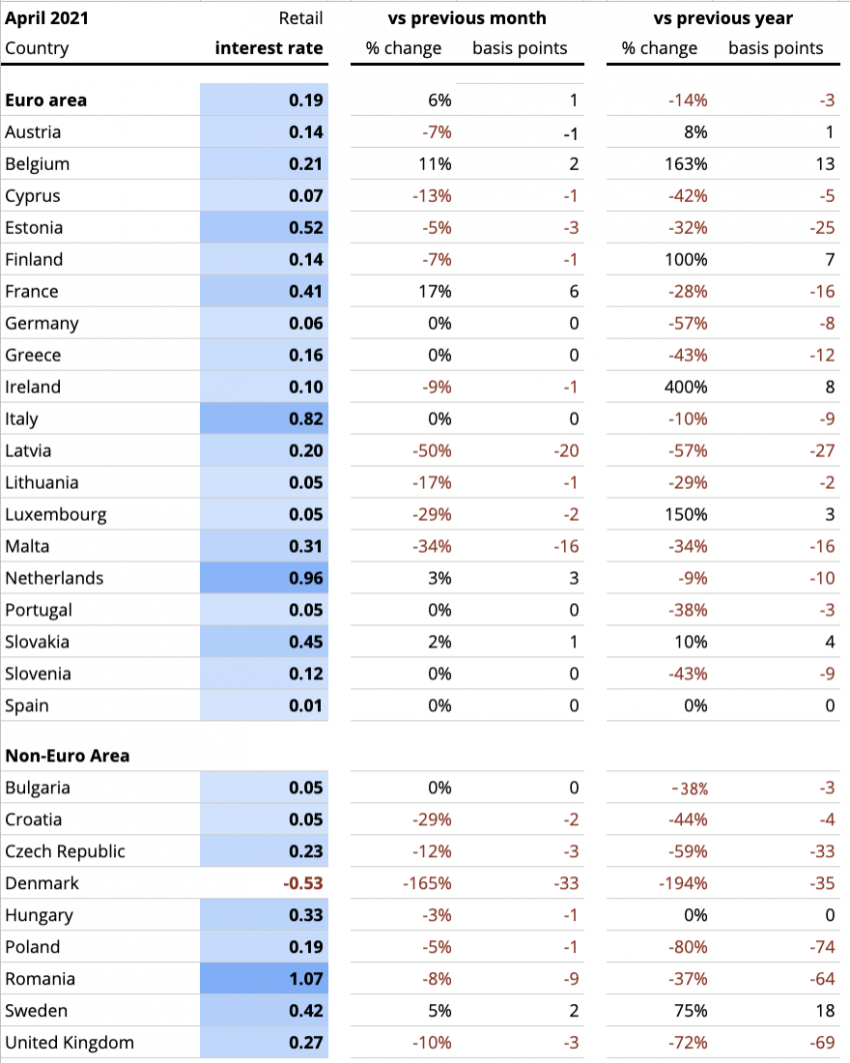

ECB data analysis: Retail rates trended upward inside and outside the eurozone

With the average interest rate in the EU’s largest economy, Germany, back above 0%, the eurozone average also ticked upward slightly to 0.17%. Indeed the largest markets in Europe, except Spain and the Netherlands, saw average rates move up, according to the ECB’s latest data.

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

- The average interest rates on 1-year term deposits in Germany, France, Italy, and the UK all rose.

- The Netherlands’ average interest fell slightly, along with Belgium and Austria, while Spain – the other exception among big economies – continued its long tradition of stagnancy with no change.

- Unusually, Estonia, Lithuania and Latvia all moved together in the recent data, downward, with their average rates falling between 1 and 17 basis points.

- Luxembourg and Denmark continue to be highly volatile – more an expression of the smaller number of banks making minor rate changes than actual economic volatility.

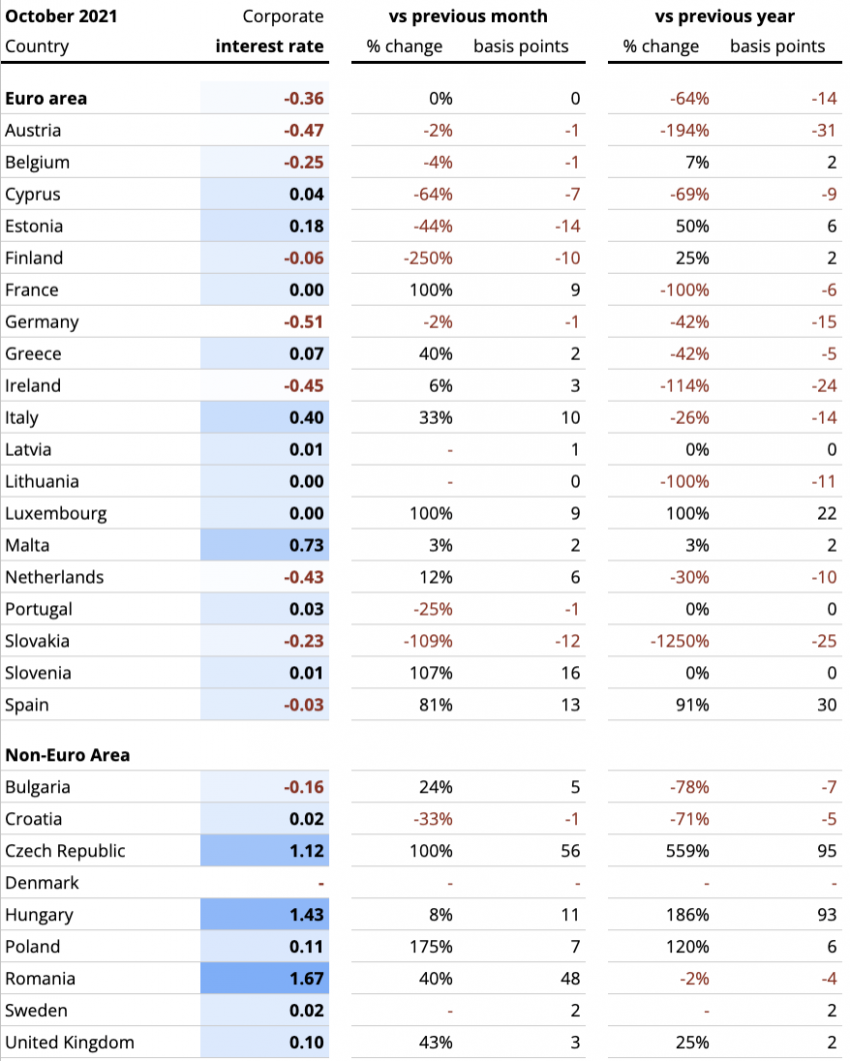

ECB data analysis: Corporate rates carve out ever lower floor with Germany sinking to new low of -0.51%

Corporate interest rates dropped in a number of smaller eurozone markets. These decreases balanced out the significant rate increases for businesses in France, Italy and Spain, leaving the eurozone average corporate rate unchanged at -0.36%.

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics. No data for Denmark was available at time of publication.

- Germany continues to push the eurozone corporate interest rate floor ever lower, now breaking past half a percent under zero for the first time to land at an average -0.51%.

- The Netherlands (-0.43%), Ireland (-0.45%), and Austria (-0.47%) remain not far behind on the negative rate ladder.

- France dropped 9 basis points to 0%.

- Opportunities for businesses to avoid negative rates remain available in Eastern Europe with average rates well above 1% in the Czech Republic, Hungary, and Romania.

- Within the eurozone, Italy (0.4%) and Malta (0.73%) offer corporates some relief with averages straddling the half a percent line.

Comment

Andreas Wiethölter, VP B2C channels at fintech Raisin DS, explains: “We’re living through a transformation of the savings market, as Europeans save more than ever and, overwhelmed by the volume of liquidity, many banks stop offering fixed-term deposits. Consumers are still making two key mistakes that reinforce this systemic bottleneck: not comparing interest rates and fees, and not diversifying their savings. When banking customers move their money into higher-yield, no-fee accounts and consider a broader range of deposit products, from their current accounts to overnight to fixed-term accounts they can ladder, they earn more and gain flexibility. At the same time, many big banks will experience the relief of less retail cash on their balance sheets.”

Sources

Raisin DS, ECB

Austria: Erste Bank, Raiffeisenlandesbank Oberösterreich, Bawag – sparzinsen-vergleich.at/

Belgium: ING Belgium, KBC, Belfius Bank – spaargids.be

France: BNP Paribas, Credit Mutuel, Societe Generale – francetransactions

Germany: Deutsche Bank, Commerzbank, HypoVereinsbank – biallo.de

Ireland: Bank of Ireland, Allied Irish Banks, Ulster Bank – ccpc.ie

Italy: UniCredit, Banca Monte dei Paschi di Siena, Mediobanca – confrontaconti.it

Netherlands: RaboBank, ING, ABN – geld.nl, spaarrente.nl

Norway: DNB, Danske, Nordea – finansportalen.no

Poland: PKO Bank Polski, Bank Pekao, mBank – oprocentowanie.pl

Portugal: Novo Banco, BPI, BCP – comparaja.pt

Spain: Santander, BBVA, Caixabank – tucapital.es

Sweden: Nordea, SEB, Svenska Handelsbanken – finansportalen.se

United Kingdom: HSBC, Barclays, RBS – which.co.uk

Caught between rising inflation and falling interest rates, consumers… just keep saving

With inflation still rising sharply across Europe – now at 5.5.% in Spain, 4.5% in Germany, and 2.6% in France, falling interest rates further dampen consumers’ ability to hold onto their savings, much less build wealth.

Savings rates went back up in September to a net gain of just over €7 billion, according to the latest European Central Bank (ECB) data, after an August of higher spending than saving. So Europeans are back to growing their bank balances rather than using their decreasing purchasing power, as the value of their money seems on the decline.

Who can benefit from low rates with high inflation?

Banks that lapped up refinancing support from the ECB now have almost 7% public sector funding, according to the European Banking Authority (EBA). Looking to bring that percentage back to pre-pandemic levels, it is just these banks that stand to gain from the current situation. Dr. Tamaz Georgadze (Raisin DS CEO) explains why in his Comment below.

November rates: Outside the eurozone, the interest rate ceiling is higher

The highest available interest rates in markets Raisin DS surveyed outside the eurozone are all over 1%, significantly higher than within the eurozone. The top offers inside the eurozone earn half that value or less, spanning from 0.550% in Belgium down to 0.037% in Ireland – with only Italy as the outlier at 0.967%. Italy also has the biggest spread of 0,883 points between top offers and rates at the three biggest banks.

- The range of interest rates available in eurozone countries remains narrow, with top rates low and largely stagnant and many of the largest banks still offering no fixed term deposits at all.

- The only top 1-year rates that moved in the eurozone were in Germany, where they fell yet again.

- Italy continues to feature not only the widest spread but also the highest interest rates in the eurozone.

- Outside the Eurozone, consumers have more interest-bearing options, with top deposit products offering interest of well over 1% in the UK, Poland, Sweden and Norway.

Notes: Some of the selected big banks offer neither a 1-year term deposit nor an account with an interest bonus after 365 days without withdrawal. Their interest rate is set at 0.0% for the calculation to represent the lack of an offer. In markets where we have only found two offers for 1-year term deposits, in total, the average is calculated with just those two values.

Comparing top rates: European markets see narrowing choice of savings products

The limited spread of interest rates across different maturities from country to country shows how consumers are left with less and less choice.

Across the eurozone this month, the highest available interest rates for 1- and 3-year term deposits stalled, after a month with scattered movement in rates, mostly upward. The one eurozone exception was Germany, where Germans saw the improvements on rates from last month disappear. Outside the eurozone Norway and Sweden moved apart from one another while the best UK 1-year interest rates lost a little ground.

- Norway alone saw both top rates on 1-year and top 3-year deposits rise, and nearly to the top of the pile.

- Just the UK has higher rates in both categories, though its recent uptick appears to be slowing with the 1-year average rate falling.

- In most of the eurozone, the spread between 1- and 3-year interest rates is at or below a quarter of a point, raising the question of whether longer-term deposits are at all worth it.

- In France and Italy, the differential is slightly higher, with 3-year deposits more than 0.4 points higher than 1-year.

- Particularly in Italy, top available interest rates are the standout exception for the eurozone, between almost 1% and 1.4%.

- Spain, at the other end of the spectrum, once again has higher rates for 1-year deposits than for 3-year.

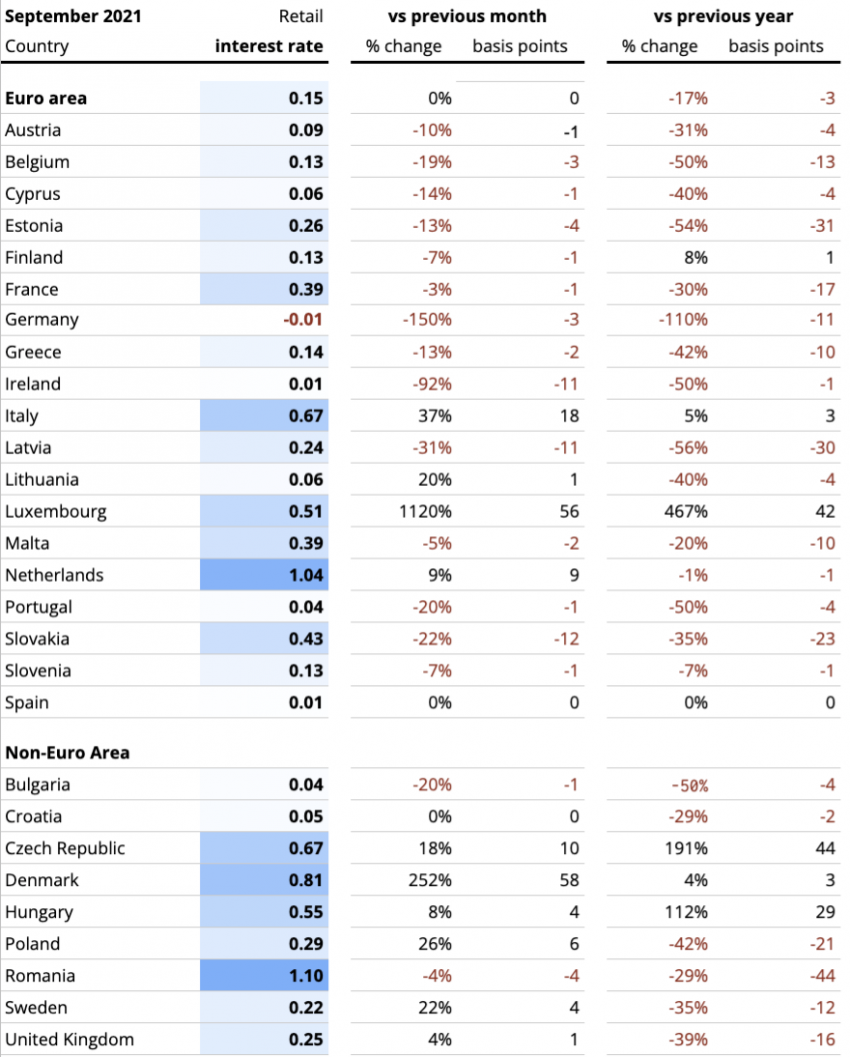

ECB data analysis: Average retail interest rates between -0.01% and 1.1% won’t help Europeans blunt inflation

The eurozone’s largest economy, Germany, saw the average retail interest drop below zero again, according to the latest ECB data for September 2021. This, despite the fact the Germans continued to spend more than they saved.

Though the only country with a negative average at the moment, Germany has company at the lower end: eleven eurozone countries in total currently have average interest rates below 0.2%. The ECB includes subsidized construction depot products in their Netherlands valuation, but it should be noted that, in fact, negative rates have been widely adopted by Dutch banks as well.

Europeans face a significant divergence in their banking options, with opportunities to earn interest on their savings dependent on which market they live in. The average rate in France is 0.4 points higher than just over the border in Germany, and in Italy it’s 0.68 points higher. In most markets outside the eurozone, consumers likewise have access to higher interest rates.

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

- From Ireland to Belgium and France, to Germany and Austria, average interest rates fell across the middle of Europe from east to west.

- The Baltics and eastern portion of the eurozone also suffered.

- The average interest rate in Germany, most notably, is once again negative.

- Of the largest nations in the eurozone only Italy saw significant increases, with the average retail rate rising 18 basis points to 0.67%.

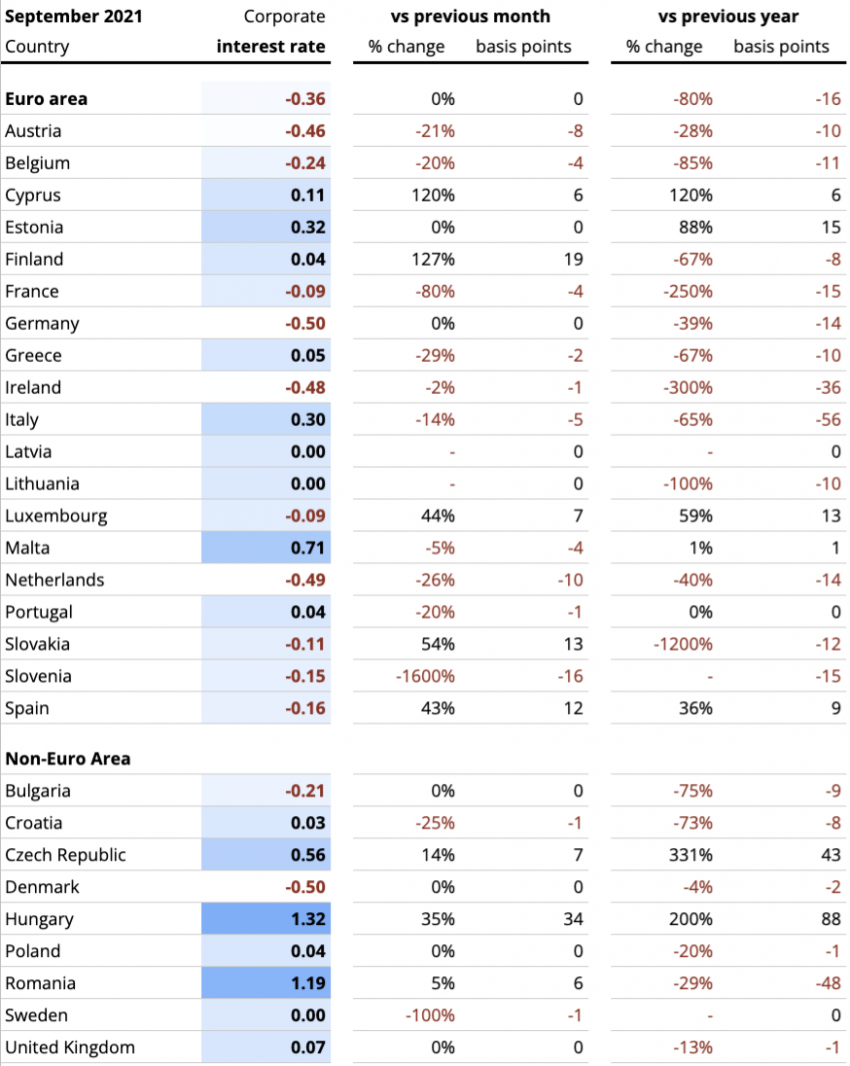

ECB data analysis: Negative corporate interest rates sweep Europe’s biggest markets

All of Europe’s larger economies – except Italy and the UK – have negative interest rates for businesses, as of the latest ECB data, including Germany, France, Spain, Austria, the Benelux countries, and Ireland. The average corporate interest rate across Europe is -0,36%.

While corporate accounts continue to have large net positive inflows, the ECB’s new data show Spain, Italy and the Netherlands with marked increases over last month. Spain’s average business interest rate nonetheless increased. But the latter two countries saw significant drops in their average rates, concurrent with the large inflows.

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

- Germany (-0.50%), Austria (-0.46%), the Netherlands (-0.49%), Denmark (-0.50%), and Ireland (-0.48%) all feature harsh average negative interest rates for business deposits.

- For both Austrian and Dutch corporates this new data indicates a fall even further below zero, of -8 and -10 basis points respectively.

- The outliers at the other end in the new ECB data were Spain along with Finland, Slovakia, and Hungary, who saw increases in their average corporate rates of between 12 and 34 basis points.

- Of Europe’s largest markets, only Italy is well above zero at 0.3% for the second month in a row. It’s a marked improvement from the data released in September, where Italy’s average business rate was down to -0.04%.

Comment

Dr. Tamaz Georgadze (Raisin DS CEO) explains how current economic circumstances of low interest rates paired with rising inflation have just one potential beneficiary:

“Low interest rates and high inflation are a disadvantage to most parties to the economy. But many banks can benefit from this situation by securing cost-efficient deposits as a step toward rebalancing their funding mix.

Banks with loans from the ECB will face the next major repayment deadlines in 2023. While some banks may be counting on the ECB cash tap staying open, the EBA has pointed to the need to begin preparing. One clear option is building their deposit funding, a particularly cost-effective venture right now with interest rates at all time lows. With digital banking platforms, banks also have the option to gather deposits in markets with lower interest rates than their own, further decreasing their cost of funding. Plus, their loans will be worth less if inflation stays at higher levels.

While consumers worry about the impact of inflation on their savings, and the biggest banks are weighed down by too much liquidity, the banks facing loan deadlines actually have an interesting opportunity in the current economy.”

Sources

Raisin DS, ECB, EBA, Trading Economics

Austria: Erste Bank, Raiffeisenlandesbank Oberösterreich, Bawag – sparzinsen-vergleich.at/

Belgium: ING Belgium, KBC, Belfius Bank – spaargids.be

France: BNP Paribas, Credit Mutuel, Societe Generale – francetransactions

Germany: Deutsche Bank, Commerzbank, HypoVereinsbank – biallo.de

Ireland: Bank of Ireland, Allied Irish Banks, Ulster Bank – ccpc.ie

Italy: UniCredit, Banca Monte dei Paschi di Siena, Mediobanca – confrontaconti.it

Netherlands: RaboBank, ING, ABN – geld.nl, spaarrente.nl

Norway: DNB, Danske, Nordea – finansportalen.no

Poland: PKO Bank Polski, Bank Pekao, mBank – oprocentowanie.pl

Portugal: Novo Banco, BPI, BCP – comparaja.pt

Spain: Santander, BBVA, Caixabank – tucapital.es

Sweden: Nordea, SEB, Svenska Handelsbanken – finansportalen.se

United Kingdom: HSBC, Barclays, RBS – which.co.uk

For the first time in 2 years, Europeans spent more than they saved — and banks may have noticed

With the European Central Bank still worried about inflation and whether supply will be able to meet demand, both in goods and labor, interest rates may have finally stopped falling. One of the potential reasons? Across Europe, household deposits saw a net drop of 10.35 billion euros between July and August, according to the ECB. Possibly in response, banks kept most retail interest rates steady, and just in the last month the top offers in some of Europe’s largest markets even went up.

Emmanuel Rodriguez, Raisin DS France Country Head, addresses the reversal of Europe’s recent savings trend:

“For the first time in two years, ECB data shows that Europeans spent more than they saved – much more. Net savings flows showed money leaving retail bank accounts in all the large European economies but France and Italy. Even in both those markets, the ECB data shows that inflows were 95% and 49% lower, respectively, than the previous month. Given fears about rising inflation, along with the increase in vaccination rates and corresponding economic activity during the summer months, it makes sense that consumers went on a spending spree. Particularly before prices go up too much further.”

Rodriguez explains below in a comment what this could mean for banks, in the broader context of inflation and economic recovery.

Good news for depositors across Europe: top interest rates are on the rise

The best interest rates went up in the UK, Sweden, Norway, Belgium, Germany, Austria, and Poland. These are averages of the top three available rates on 1-year deposits in each market listed below. Interest rates on the same deposits at each market’s biggest banks, meanwhile, stayed the same, by and large painfully low – or, as in Germany, Spain, the Netherlands, and Poland, there are simply no such products available. All except in Norway where big bank rates ticked slightly upward.

- The United Kingdom together with Italy and the Scandinavian countries are the markets with the widest spreads between interest rates at the big banks and top available rates.

- Germany isn’t far behind with more than half a percent difference between what depositors at the three largest banks can earn – nothing, there aren’t any deposits, or in some cases even negative interest – and the best offers on the market at an average 0.633%.

- From the Netherlands to Ireland to Spain, the countries at the bottom of the list, while bad for consumers, offer opportunities for banks in need of stable retail funding. Fixed-term deposits deliver it, and in these markets, it’s especially cost-effective to compete for them.

Notes: Some of the selected big banks offer neither a 1-year term deposit nor an account with an interest bonus after 365 days without withdrawal. Their interest rate is set at 0.0% for the calculation to represent the lack of an offer. In markets where we have only found two offers for 1-year term deposits, in total, the average is calculated with just those two values.

Short or longer-term deposits? Upwards trends for both, if faint-hearted

Every top 1-year interest rate measured below went up or held steady this month, except in Spain. Consumers in the UK, Sweden, Germany and Poland now all have higher interest rates to choose from than last month in the most popular 1-year as well as the 3-year category. The spread between shorter and longer term interest rates has remained narrow, but from the Netherlands to France and Italy to Scandinavia there are significant returns to be had in going longer-term.

- Depositors who can access bank offers from Scandinavia, Italy, and the UK, stand to alleviate the worst effects of inflation on their savings, if not earn a few euros.

- In these countries the best interest rates on 1-year fixed term deposits are above 1%. For customers willing to tie up some of their savings for 3 years, they can get rates near or even above one and a half percent.

- Banks that can access Spain, the Netherlands, and Ireland, along with deposit-rich Germany, will be able to raise deposit funding cheaply, with the highest available interest rates on 1-year deposits now between about 0.4% and 0.04%. Banks located in those three markets are more likely trying to offload liquidity than attract it.

ECB data analysis: Small drops in big countries drove Eurozone average rate down, but more markets hung on or gained ground

Interest rates for retail customers held more or less steady for most Europeans, according to the ECB’s latest data, for August 2021. This could stem from the significant net outflows from household deposits, possibly causing banks to make only small changes if any at all.

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

- Of Europe’s largest markets, France, Italy, and the Netherlands saw slight decreases on average, despite the quiet month overall.

- Germany and Spain held firm at near zero average rates, 0.02% and 0.01% respectively. Given the double threats of negative interest and rising inflation – 3.9% for Germans and 4% for the Spanish – this news may actually be welcome.

- The average interest rate in the UK didn’t change between July and August. But increases in the market’s best offers just in the last two months suggest that that number will go up, as the data trickles in over the coming months.

ECB data analysis: As business deposit inflows continue to rise, their interest rates remain volatile – though mostly downward

Net flows of deposits on corporate accounts have continued to increase across Europe, unlike household accounts, though less so in the largest economies of Germany, France, Italy and Spain. Interest rates in turn continued to fall, with Germany and Denmark pushing the floor ever downward.

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

- Germany’s businesses face a new low of -0.50% average interest on their cash deposits.

- A record 12 European Economic Area countries now have negative average interest rates for corporates.

- Business deposits in France, the Netherlands, Belgium, Austria, Ireland and a handful of smaller countries also saw their average rates fall to, below, or even further below 0%.

- Spain’s corporates are paying negative rates on average again after a brief respite above 0%.

Comment

Country Head of Raisin DS France Emmanuel Rodriguez addresses the ECB’s new data on savings flows and what it could indicate for banks and their cash management strategy going forward:

“From new ECB data, we can see that Europeans stopped socking away all their cash in August and started spending again. With more jobs than workers, people are also in the strongest position they’ve been in to negotiate better salaries or wages. The central bank has expressed concerns about the possibility of wage increases leading to further inflation. But job creation could lead to further economic growth too, and boost the return of European consumers’ confidence, which could lead them to prioritise further spending over saving.

This, in turn, could motivate banks to raise interest rates on savings to avoid a weakening liquidity position going forward, even if they currently enjoy a very comfortable funding situation. France has the lowest inflation rate of the five largest EU economies, currently right about at the target with 2.1%, and could thus be most likely to experience these trends and see consumer confidence, and spending, catch up with its European neighbours.”

Sources

Raisin DS, ECB, Trading Economics

Austria: Erste Bank, Raiffeisenlandesbank Oberösterreich, Bawag – sparzinsen-vergleich.at/

Belgium: ING Belgium, KBC, Belfius Bank – spaargids.be

France: BNP Paribas, Credit Mutuel, Societe Generale – francetransactions

Germany: Deutsche Bank, Commerzbank, HypoVereinsbank – biallo.de

Ireland: Bank of Ireland, Allied Irish Banks, Ulster Bank – ccpc.ie

Italy: UniCredit, Banca Monte dei Paschi di Siena, Mediobanca – confrontaconti.it

Netherlands: RaboBank, ING, ABN – geld.nl, spaarrente.nl

Norway: DNB, Danske, Nordea – finansportalen.no

Poland: PKO Bank Polski, Bank Pekao, mBank – oprocentowanie.pl

Portugal: Novo Banco, BPI, BCP – comparaja.pt

Spain: Santander, BBVA, Caixabank – tucapital.es

Sweden: Nordea, SEB, Svenska Handelsbanken – finansportalen.se

United Kingdom: HSBC, Barclays, RBS – which.co.uk

‘Buy while supplies last!’ Interest rates expected to keep sliding, inflation to fall as well

“Liquidity remains abundant.” The European Central Bank thus neatly summed up current conditions for banks and consumers alike in its recent Economic Bulletin, further confirming at the 9. September press conference that its key interest rates will remain the same. With lending rates “historically low” as the Bulletin shows, and savings volume across Europe still at record levels, banks tend to have plenty of deposit funding on hand – leaving consumers with ever lower interest rates. The European Banking Association also confirmed its expectation that rates will continue to decrease in a recent announcement, stating that “most banks expect funding conditions to remain very benign and costs to decline even further.”

The current Raisin DS Interest Rate Tracker finds that Europeans are indeed stuck in a low interest rate feedback loop. Katharina Lueth, Raisin DS Managing Director and Vice President Europe, points out: “Temporary inflation will readjust downwards as people have more confidence that the pandemic will end and as supply chains straighten out, people will spend more if they’re more confident and prices go down, the economy will bounce back even faster if people spend more, banks will lend more if the economy rebounds… And then interest rates could start rising again. Ideally.” The latest announcements show how far off Europe is from such a conclusion. In a comment below, Lueth analyses the challenges and opportunities consumers are facing with the current development of saving rates and inflation.

More and more of Europe’s biggest banks too flush with cash to offer term deposits

While interest rates at the biggest banks across the continent continued to gather in the dustbin as the banks discontinue term deposit products, the top available rates on 1-year term deposits inched upward in most of the biggest markets. Germany, the Netherlands, Italy, and the UK all saw increases in the best yields this month.

- Only in the UK was the change really meaningful, moving from 1.113% to 1.423%. The Spanish top rate only moved upwards because the lowest of the three offers in the Raisin DS average was discontinued.

In Spain, the Netherlands, Germany, and Poland the largest banks are a term deposit desert, offering no 1-year products at all. - Only in the UK and Belgium do customers at the big banks have at least a tenth of a percent – in Norway over 0.5%.

Notes: Some of the selected big banks offer neither a 1-year term deposit nor an account with an interest bonus after 365 days without withdrawal. Their interest rate is set at 0.0% for the calculation to represent the lack of an offer. In markets where we have only found two offers for 1-year term deposits, in total, the average is calculated with just those two values.

Interest rates of term deposits offer glimmers of opportunity, if not hope

Europeans continue to keep the bulk of their money in their current accounts earning nothing – or worse, are paying to save. According to Raisin DS’s latest research, they still have some options, with the highest rates to be found in the Nordic countries, the UK, Italy, France, and Poland.

- While top interest rates in the UK jumped to over 1.7% for 3-year deposits and over 1.4% for 1-year products, continental Europe struggled along with only slight changes.

- We see upward movement in Germany, the Netherlands, Portugal, and Sweden for both 1- and 3-year term deposit rates, but it won’t add up to much unless the trend continues.

- Overall however, in contrast to last month, most developments are positive, if only fractionally in most markets.

ECB data analysis: In most of Europe, retail interest rates have barely moved since the pandemic started

The eurozone average retail interest rate crawled upward the slightest fraction since last month. But more strikingly, a year and a half since the pandemic started (comparing data from January 2020 to today), average rates have changed only marginally in most European countries.

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

- Of the larger European markets, consumers in the Netherlands, Germany, Spain, Belgium and Austria as well as Sweden are facing nearly the same interest rates on average that they had before Covid-19 upended the economy and the world (at the start of 2020). That’s how stuck rates are in much of Europe.

- A handful of outliers provide the exceptions to the rule. In Estonia, Poland, the Czech Republic, France, Italy and even the UK, average depositors saw their rates fall to under half what they were before the pandemic.

- In several cases, though, this was only because their average interest rates had risen briefly at the start of 2020.

- Retail interest rates in Germany have moved from a record low in last month’s ECB data to back above zero, continuing a yo-yo effect that market has experienced since December 2020.

ECB data analysis: Covid-19 hit corporate interest rates hard, with the eurozone average at -0.31%

The eurozone average corporate interest rate has lost three tenths of a point since the pandemic began. Corporates in Benelux, France, Germany, and even Italy are paying negative rates.

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

- Average interest rates for businesses in most of Europe’s largest markets fell precipitously between the start of the pandemic and now.

- That includes Germany, Austria, the Netherlands, Italy, Greece, Spain, and Ireland, which all fell, typically around three tenths of a percent (explaining the eurozone average loss).

- Italy stands out this month for having dipped below zero again: Italian businesses are now paying on average negative interest on their deposits.

- Countering the trend, markets like Spain and Malta saw big increases in their corporate rates between January 2020 and today, Spain up from -0.22% before the pandemic and Malta up from 0.14%.

Comment: Raisin DS Managing Director and VP Europe Katharina Lueth explains how consumers can respond to the latest economic predictions

“According to continuing record volumes of cash sitting in current accounts, Europeans want to have money on hand. As the pandemic recedes and the economy bounces back, consumers will eventually start spending at pre-pandemic levels again. That will mean moving some of their savings out into the economy. It will also be the moment many people feel confident enough to put money into longer-term investment vehicles, including term deposits.

But Europeans would be well-advised not to wait but to lock in current interest rates now. If inflation pressures abate but interest continues to stagnate or fall, as the ECB and EBA both expect, depositors who invest with today’s rates will be further compensated – recovering the value of their money, along with earning better yields. Given these expectations it may make sense to consider medium term deposit products with 2-year terms or even longer. Banks are counting on the cost of funds to continue decreasing. The central bank trusts the economy to improve. Consumers should take note.”

Sources

Raisin / WeltSparen, ECB, European Banking Association

Austria: Erste Bank, Raiffeisenlandesbank Oberösterreich, Bawag – sparzinsen-vergleich.at/

Belgium: ING Belgium, KBC, Belfius Bank – spaargids.be

France: BNP Paribas, Credit Mutuel, Societe Generale – francetransactions

Germany: Deutsche Bank, Commerzbank, HypoVereinsbank – biallo.de

Ireland: Bank of Ireland, Allied Irish Banks, Ulster Bank – ccpc.ie

Italy: UniCredit, Banca Monte dei Paschi di Siena, Mediobanca – confrontaconti.it

Netherlands: RaboBank, ING, ABN – geld.nl, spaarrente.nl

Norway: DNB, Danske, Nordea – finansportalen.no

Poland: PKO Bank Polski, Bank Pekao, mBank – oprocentowanie.pl

Portugal: Novo Banco, BPI, BCP – comparaja.pt

Spain: Santander, BBVA, Caixabank – tucapital.es

Sweden: Nordea, SEB, Svenska Handelsbanken – finansportalen.se

United Kingdom: HSBC, Barclays, RBS – which.co.uk

For EU savings, it’s single market, shmingle market: Germans pay negative interest, while French and Italians earn 12 times the yield

The average interest rate in Europe’s largest economy, Germany, has once again fallen below zero to a new record low of -0.04%, according to the European Central Bank’s latest data. But across Europe, consumers and businesses face widely varying conditions and uneven access to interest-bearing savings products. Spanish consumers likewise face a stagnant average interest rate of 0.01%, but in both France and Italy, the average interest rate is nearly half a percent (0.47%).

The differential between Germany on the one hand and Italy and France on the other is as stark for businesses. Germany’s corporate interest rate fell to a new low of -0.49%, while French and Italian corporates face just 0% and 0.18% average interest rates on their short term deposits, respectively.

Europe divided between competitive and non-competitive markets: Consumers in countries with an interest rate spread still have choices

According to Raisin DS’s new research into interest rate spreads, interest rates for consumers in Europe’s big markets have split in two directions: Germany, Austria, France, and Spain are facing sharply narrowing options, while the UK, Italy and Scandinavian countries continue to feature a meaningful spread of interest rates, from above 0.8 point in Italy, to over 1 point in the UK, Sweden, and Norway. The highest available German, French, Spanish and Austrian interest rates on 1-year deposits continue to fall, while the largest banks in those markets have little to no interest to offer their customers.

For instance, in Spain: Between the three largest banks at 0% and best offers at 0.267%, consumers are left with a spread of not quite 0.3 points to choose from, when investing their savings in fixed-term deposits. In Germany, consumers have a spread of just 0.5 points between 0% at the biggest banks and the best offers at about 0.5%.

Below in the Comment, Dr. Verena Thaler, Raisin DS VP Strategy & Business Development, explains the connection between the unfinished Banking Union and the disparity in access to competitive rates across Europe.

Banks in more competitive markets have cross-border funding opportunities

The dramatic differences between these two tracks (Germany to Spain, vs. the UK to Scandinavia) signify funding possibilities for banks in the competitive markets. Offering deposits in the less competitive markets can mean not just diversifying but also raising liquidity more cost-effectively than in their own markets.

- Big banks at zero: Customers at the biggest three banks in Germany, the Netherlands, and Spain respectively, currently have no interest-bearing fixed-term deposit options in the most popular category (1-year).

- Under 0.05%: The largest banks in Austria and Poland, along with Sweden, France, Ireland, and Portugal, feature 1-year fixed-term options but with rock bottom rates – averaging at or under (well under) 0.05%.

- Around 0.1%: Consumers banking with the big banks in Belgium, Italy, the UK have choices at or over 0.1%, still not nearly high enough to offset inflation.

- Almost 0.5%!: Norway is the outlier among Europe’s biggest economies: Norwegians banking at the three largest banks can find 1-year deposit products with interest rates at nearly half a percent.

- Top rates over 1%: Meanwhile consumers in Norway, Sweden, and the UK can select the best available 1-year deposit products – offers from smaller banks – for rates above 1%. In Poland and Italy, for interest at almost 1%.

Top 1-year and 3-year interest rates sink, but some Europeans still have options

European households saw a 10% increase in net inflows, according to the ECB’s newest data, between May and June 2021. With saving volumes still at record levels, nearly all European consumers can earn interest on their money – and offset inflation – only by moving cash away from the biggest banks.

- In all of Europe’s large economies except the UK, however, top available interest rates stayed in place, or slid further downward.

- Only in the UK did average top rates for fixed-term deposits tick upward in a meaningful way.

- Germany’s average highest 3-year rates climbed as well, but only fractionally.

- In the less competitive markets, consumers can nonetheless seek yields on their savings many times higher than the low or even negative rates at the biggest banks. In Spain, the top 1-year offers at 0.267% are better than 0% and the 3-year interest rates, at 0.425%, even better than that.

Notes: Some of the selected big banks offer neither a 1-year term deposit nor an account with an interest bonus after 365 days without withdrawal. Their interest rate is set 0.0% for the calculation to represent the lack of an offer. In markets where we have only found two offers for 1-year term deposits, in total, the average is calculated with just those two values.

ECB data analysis: Retail interest rates expose wide spreads across Europe

The latest ECB data from June 2021 reveals that the eurozone average interest rate for consumers has now fallen to a new low of 0.14%. Many European Economic Area countries we survey here plus the UK have lower average interest rates today than one year ago – all except for four, Belgium, Finland, Ireland and Luxembourg, plus Spain which has stayed put at a dismal 0.01%.

Seven eurozone countries now have average 1-year interest rates at or below 0.1% – in the case of Germany, below 0% as the only eurozone country with a negative rate. Two EU countries outside the eurozone have joined them below 0.1%, with an additional eight countries within and out of the eurozone featuring average interest rates below 0.3%.

Retail Rates

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

- As noted above, Germans face negative interest rates, with the new record low average rate at -0.04%. (The first time Germany’s already low average retail rate went negative was at the end of 2020, sinking briefly to -0.01%.)

- Likewise Spain’s average interest is at a low of 0.01%, Austria is at 0.03%, and Portugal’s at 0.05%.

- Meanwhile, in Italy and France consumers are earning nearly half a point more on their deposits, with 0.47% interest on average.

- The UK and Sweden both feature lower but, in this low interest context, respectable averages of 0.27% and 0.23%, respectively.

- The Netherlands’ average rate, as usual, is heavily distorted by the ECB’s inclusion of a state-subsidized construction deposit product. In fact (as Raisin DS’s research above makes visible), Dutch savers face low rates similar to Germany.

ECB data analysis: Corporate interest rates plunge to new lows, driven by ten markets below 0%

The average eurozone interest rate for businesses has fallen to a new low of -0.31%. Eight eurozone countries along with two markets outside the zone have average negative rates for corporates, with Germany and Ireland the most punishing at nearly half a point below zero.

Corporate Rates

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

- Germany, Denmark, and Ireland are currently the costliest markets for businesses to hold deposits in, with negative average corporate rates between -0.45% and -0.49%.

- The Benelux countries, Austria and several Eastern European markets aren’t much better, with average interest rates ranging between -0.26% and -0.37%.\

- Along the Mediterranean, Spain recovered somewhat, its corporate rate jumping 33 basis points to 0.2%, from negative territory last month. Italy tanked though, falling to its lowest business rate in a long time, 0.18%, down from an average 0.48% last month.

Comment

Dr. Verena Thaler, Raisin DS VP Strategy & Business Development discusses the lack of competition and access in an increasing number of European markets, in the context of the single market and Banking Union:

Despite interest rates falling to all-time lows in many EU countries, both European consumers and banks face widely divergent opportunities from the savings market. Europeans continue to save more than ever and companies have increased their liquidity position. Yet, only some have access to competitive interest rates within their own markets while others are penalized with negative interest (especially SMEs and business clients). Likewise the cost of retail deposit funding varies broadly for European banks depending on the country.

Raisin DS VP Strategy & Business Development Dr. Verena Thaler. Foto (c) Lukas Schramm

One crucial step to remedying this inequality of opportunity is to strengthen the European Banking Union, a move the European Central Bank (ECB) continues to push for. As ECB VP Luis de Guindos pointed out in his March 2021 speech on the subject, the Banking Union will bring greater stability to European banks, and thus also consumers. Increased stability means both consumers and banks can more securely pursue opportunities not just in their own markets but anywhere within Europe – including competitive savings offers and competitive liquidity sources. Particularly essential to this Europe-wide security and thus increased opportunity, as de Guindos explained, is the establishment of a single, harmonised European Deposit Insurance Scheme (EDIS).

Research by the European Commission earlier this year found support across the Eurozone for the Euro to be at 80%. This is an especially strong sign of support for the single market and our currency union that creates benefits and opportunities for all. Now Europe needs its Banking Union so everyone, consumers, companies and banks, can have the same access to the best that European markets have to offer.

Sources

Raisin DS / WeltSparen, ECB, European Commission

Austria: Erste Bank, Raiffeisenlandesbank Oberösterreich, Bawag – sparzinsen-vergleich.at/

Belgium: ING Belgium, KBC, Belfius Bank – spaargids.be

France: BNP Paribas, Credit Mutuel, Societe Generale – francetransactions

Germany: Deutsche Bank, Commerzbank, HypoVereinsbank – biallo.de

Ireland: Bank of Ireland, Allied Irish Banks, Ulster Bank – ccpc.ie

Italy: UniCredit, Banca Monte dei Paschi di Siena, Mediobanca – confrontaconti.it

Netherlands: RaboBank, ING, ABN – geld.nl, spaarrente.nl

Norway: DNB, Danske, Nordea – finansportalen.no

Poland: PKO Bank Polski, Bank Pekao, mBank – oprocentowanie.pl

Portugal: Novo Banco, BPI, BCP – comparaja.pt

Spain: Santander, BBVA, Caixabank – tucapital.es

Sweden: Nordea, SEB, Svenska Handelsbanken – finansportalen.se

United Kingdom: HSBC, Barclays, RBS – which.co.uk

Interest rates in the summer slump?

Savings interest rates hit record low according to the ECB

- According to the ECB, retail interest rates in the eurozone have again dropped to 0.16% on average, the lowest average interest rate on record.

- Negative interest rates for corporate clients have set a new record with an average rate of -0.24%.

- More and more major banks are no longer offering savings products to private customers. First banks are withdrawing completely from the retail business.

More and more financial institutions across Europe are being affected by negative interest rates, which begs the question: are retail deposits bringing banks to their knees? Financial market expert Dr. Tamaz Georgadze, Co-CEO of Raisin DS, summarizes the findings and comments on current developments:

“Many European financial institutions no longer even offer savings products to private customers. The example of the Dutch Rabobank shows the consequences of permanently low interest rates. It is discontinuing its RaboDirect private customer business in Germany at the end of the year. This affects 250,000 German private customers with more than eight billion euros in assets.” But why?

“A combination of high savings, cheap funding from the European Central Bank, and low interest rates, has a negative impact on the profitability of the direct banking business in the long term,” says Klaus Vehns, European Head of Direct Banking and Head of Germany at Rabobank, explaining the move. It is not the first bank in Europe to withdraw from retail banking this year due to excessive savings volumes.

The European Central Bank’s (ECB) recent policy review does not indicate immediate improvement either. The long-term inflation target has now been set at exactly two percent and no further measures have been taken, although ECB Director Isabel Schnabel herself recently forecasted inflation of over three percent for Germany.

Accordingly, there is currently no hope for improvement at the markets. On the contrary, retail interest rates have dropped to the previous all time low of 0.16%. The rates for corporate clients have even reached a new all time low with -0.24%, falling two basis points below the previous all time low of -0.22%.

WeltSparen’s interest rate radar analyzes the highest available interest rates in the European markets as well as the average interest rates of the three largest banks in each country. In addition, the WeltSparen interest radar evaluates savings interest rates in Europe for private and business customers based on ECB data.

Summer blues: interest rates – few changes at big banks and top offers

In large parts of Europe the situation remains unchanged. Most of the big banks still offer only low interest rates or no fixed-term deposits at all. The interest rates of the top fixed-term deposit offers are also generally stagnating, so that interest rate hopping between different savings offers is only useful in a few cases. In Germany, the average prime rate of the top three offers on the market remains unchanged at its previous low of 0.523%.

- Norway remains the frontrunner, both for the largest banks (0.483%) and for the top offers (1.217%).

- In Poland, the United Kingdom and Italy, top offers have reached or surpassed the 1% mark.

- Beyond that, there were changes only in the Netherlands and France.

- In France, the top interest rates for one-year investments rose by around seven basis points to 0.517%, while in the Netherlands they fell slightly – to now 0.35%.

- At 0.050%, Ireland is still last, just behind Spain, which is in second-to-last place at 0.267% for 1 year fixed-term deposits.

Summer Break: Top 1-year and 3-year deposits mostly the same

In many markets, there were no changes in interest rates compared with the previous month for either the top 1-or 3-year fixed-term deposit products. The changes that did occur were mostly positive. Only in the Netherlands did interest rates fall for both 1-and 3-year deposit products. Meanwhile in Italy and Portugal, there was a decline only for 3-year deposits.

- Germany is stagnating at 0.523% for 1-year and 0.587% for 3-year time deposits. At 0.064, it has the lowest average interest rate differential after Ireland (0.050).

- In the United Kingdom and Poland, interest rates rose for 1- and 3-year savings products.

- Italy still offers the highest interest rates in the eurozone in both categories.

- The comparison continues to be dominated in both categories by markets that are not members of the euro-area: Sweden, Norway, the United Kingdom and Poland. Only in the case of 3-year deposits Italy continues to rank third, despite a recent decline.

Notes: Some of the selected big banks do neither offer a 1-year term deposit nor an account with an interest bonus after 365 days without withdrawal. Their interest rate is set 0.0% for the calculation to represent the lack of an offer. In markets where we have only found two offers for 1-year term deposits, in total, the average is calculated with just those two values.

ECB data analysis: Retail interest rates back at all time low

According to the latest ECB data, interest rates for private customers in the eurozone have fallen back to their all-time low of December 2020, after a slight recovery. Savers can now earn an average of only 0.16% interest. Meanwhile, the picture for the EU’s largest economies is mixed. Despite declines, interest rates in France and Italy are still at 0.40% and 0.60% respectively. On the other hand, savers in Spain and Germany are earning virtually no return at 0.01%. The situation is particularly painful for German savers as the interest rate has fallen to its lowest since the start of the year, and that too with a high preliminary inflation rate of 2.3% in June. This puts the interest rate just two basis points above the negative record of -0.01% in December 2020.

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

- In Germany, the average interest rate for new deposits of up to one year decreased by 83% to 0.01%, and thus almost into the negative zone; compared to the previous year, the interest rate even fell by 95%.

- Across Europe, Italy recorded the biggest drop in absolute terms with -22 basis points, but still has the third-highest interest rates at 0.60%.

- In Europe, savers in Romania (1.09%) and the Netherlands (0.88%) receive the highest interest rates.

- In Spain (0.01%), Portugal (0.05%) and Cyprus (0.07%), interest rates are stagnating at a low level.

- In the consumer segment, Denmark remains the only country in the EU with negative interest rates at -0.24%. Meanwhile, one of the long-time bottom performers in the table, namely Ireland, celebrates an average of 0.13%, a massive year-on-year increase of 550%.

ECB data analysis: Corporate interest rates set new record low

A drop of six basis points makes business customers in the euro-zone face a new negative record: they have to pay an average of -0.24% penalty interest on 1-year deposits. Business customers from Ireland and Luxembourg are hit even harder, having to pay an average interest rate of -0.43%. Again, the largest economies show different developments. While France and Germany recorded a drop of around ten basis points, interest rates in Spain rose by ten basis points and in Italy by 17 basis points.

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

- Business clients in eleven countries have to pay penalty interest.

- In Germany, the Netherlands and Austria, the penalty interest rates each amount to around -0.35%.

- Compared with the previous month, interest rates in France fell by 8 basis points back to below zero (-0.02%).

- Denmark has the highest negative rate charges with -0.50%. Luxembourg and Ireland are in second-to-last place, each with -0.43%.

- Romania, Malta and Italy offer the highest interest rates for business customers in Europe, at 1.07%, 0.70% and 0.48% respectively.

SOURCES

Raisin / WeltSparen, ECB, DESTATIS, Handelsblatt, Rabobank

Austria: Erste Bank, Raiffeisenlandesbank Oberösterreich, Bawag – sparzinsen-vergleich.at/

Belgium: ING Belgium, KBC, Belfius Bank – spaargids.be

France: BNP Paribas, Credit Mutuel, Societe Generale – francetransactions

Germany: Deutsche Bank, Commerzbank, HypoVereinsbank – biallo.de

Ireland: Bank of Ireland, Allied Irish Banks, Ulster Bank – ccpc.ie

Italy: UniCredit, Banca Monte dei Paschi di Siena, Mediobanca – confrontaconti.it

Netherlands: RaboBank, ING, ABN – geld.nl, spaarrente.nl

Norway: DNB, Danske, Nordea – finansportalen.no

Poland: PKO Bank Polski, Bank Pekao, mBank – oprocentowanie.pl

Portugal: Novo Banco, BPI, BCP – comparaja.pt

Spain: Santander, BBVA, Caixabank – tucapital.es

Sweden: Nordea, SEB, Svenska Handelsbanken – finansportalen.se

United Kingdom: HSBC, Barclays, RBS – which.co.uk

High inflation temporary, but not low rates, says ECB

Interest rate spread indicates liquidity imbalances still plague European banking

The European Central Bank has indicated that it sees rising inflation as a temporary phenomenon, but not low interest rates. The bank intends to keep clamping down on rates through the first quarter of 2022. The ECB’s new retail interest rate data shows another slight uptick, the third month in a row that rates avoided slipping on average. The increases we see in the latest ECB numbers are starting from deep lows, though, with the Eurozone average overall at 0.19%.

Where is there too much cash, and where not enough? Interest rate spread across Europe narrows but a 1-point difference remains

Raisin’s own research into the highest available rates market to market, as well as the lowest – in the form of averages of rates from each country’s three largest banks – indicate that the spreads of interest within markets are contracting. The big banks are offering ever lower interest rates but the top rates are falling faster. In Germany, for instance, the trend may be about to accelerate: the highest court has just forbidden banks from offsetting their costs by charging existing customers higher or extra fees – exposing the country’s banks to steep new liabilities, an estimated 300 million euros for Deutsche Bank alone.*

There is still a 1.06 point spread in average retail interest rates across the European Economic Area, however, according to the ECB’s numbers, and our own data shows a 0.966 point spread in top interest rates across the main European markets.

Both the average spread and that of the highest rates point to cross-border opportunities for banks and depositors alike. Banking expert and Raisin Head of Partner Bank Management and Operations Matthias Klaubert explains below how sustained low interest is changing the range of products available to consumers and impacting the liquidity imbalance in the banking industry.

- The highest interest rates in the Eurozone countries took a plunge – all except for France and Belgium. The average top interest on 1-year deposits in Italy is now below 1%, and at a new low of 0.523% in Germany.

- France hung on to its 0.45% top rate and Belgium to its 0.55%.

- Outside the Eurozone the situation was more stable, with Sweden, Norway, and Poland the same.

- Only the UK climbed a fraction, the one market we looked at to go up – more than a tenth of a percent again for the second month in a row.

- Many of the continent’s biggest banks meanwhile offer no 1-year fixed term deposits at all, including in Germany, Spain, and the Netherlands. The big banks in Ireland, France, Poland, and Austria have few offers, and at rock bottom interest.

- Only in Belgium, Italy, and Norway do most of the largest banks offer not just 1-year fixed term products but on average more than a tenth of a percent interest. (In Italy, it must be said, this is only one of the largest banks, with the other two offering no 1-year deposit products.)

Top 1-year versus top 3-year deposit rates in European countries

Within the Eurozone only in Italy are the highest 3-year interest rates above 1%, while all the top 1-year rates have sunk below the 1% marker. But outside the zone, all the countries we surveyed – from the UK to Poland to Scandinavia – have relatively strong top 3-year rates well over 1%, and 1-year rates following the same trend, near or even above 1%.

- Norway, Sweden, and Italy continue to feature the highest 1- and 3-year fixed term deposit interest rates, in our survey of Europe’s largest markets, with the UK not far behind.

- The best available 3-year fixed-term interest rates sank for the most part across the Eurozone, going down in Germany, Spain, Portugal, the Netherlands and Ireland.

- Italy, France and Belgium stayed the same, however, with a high 1.575% average on top 3-year rates holding firm in Italy.

- Outside the Eurozone, the UK saw an increase up to a 1.12% average.

- In Germany, Belgium, and Ireland, the spread between 1- and 3-year top interest rates has narrowed even more, now at or under one tenth of a point.

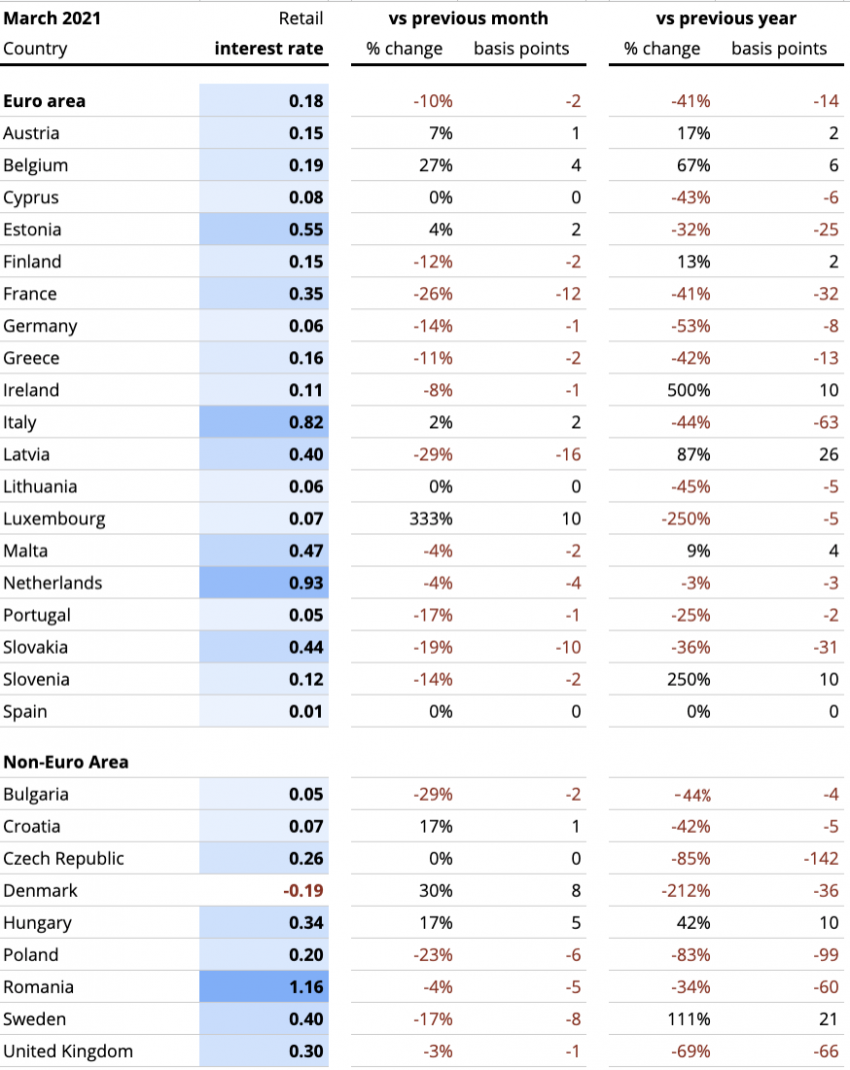

ECB Data: Retail Interest Rates

Average retail interest rates remain at or below 0.2% in 15 countries across Europe, but since one year ago several markets have experienced notable swings. Italy’s average rate dropped from 1.55% last March, at the start of the pandemic, to 0.82% in the most recent data. The UK fell from 1.04% to today’s 0.27%, France from 0.76% to 0.41%, and Poland all the way from 1.2% last year to 0.19% now.

Of the continent’s larger countries only Sweden bucked the trend, rising from an average retail rate one year ago of 0.15% to 0.42% now. Belgium more than doubled its average but just at a low range, from 0.09% to 0.21% now.

Retail Rates

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

- Four of the larger countries (France, Belgium, Netherlands and Sweden) experienced small increases in the average interest rate, between 2 and 6 basis points.

- Meanwhile Germany stayed the same at an average of 0.06%, along with Italy (0.82%) and Spain (0.01%) and Greece (0.16%).

- Italy’s high average at 0.82% remains an outlier among the big economies (when you exclude the Dutch average rate, whose calculation includes dedicated building-focused savings products).

- Several smaller European markets – Denmark, Latvia, Malta – saw sharp decreases in their average interest rates, from -16 to -33 basis points.

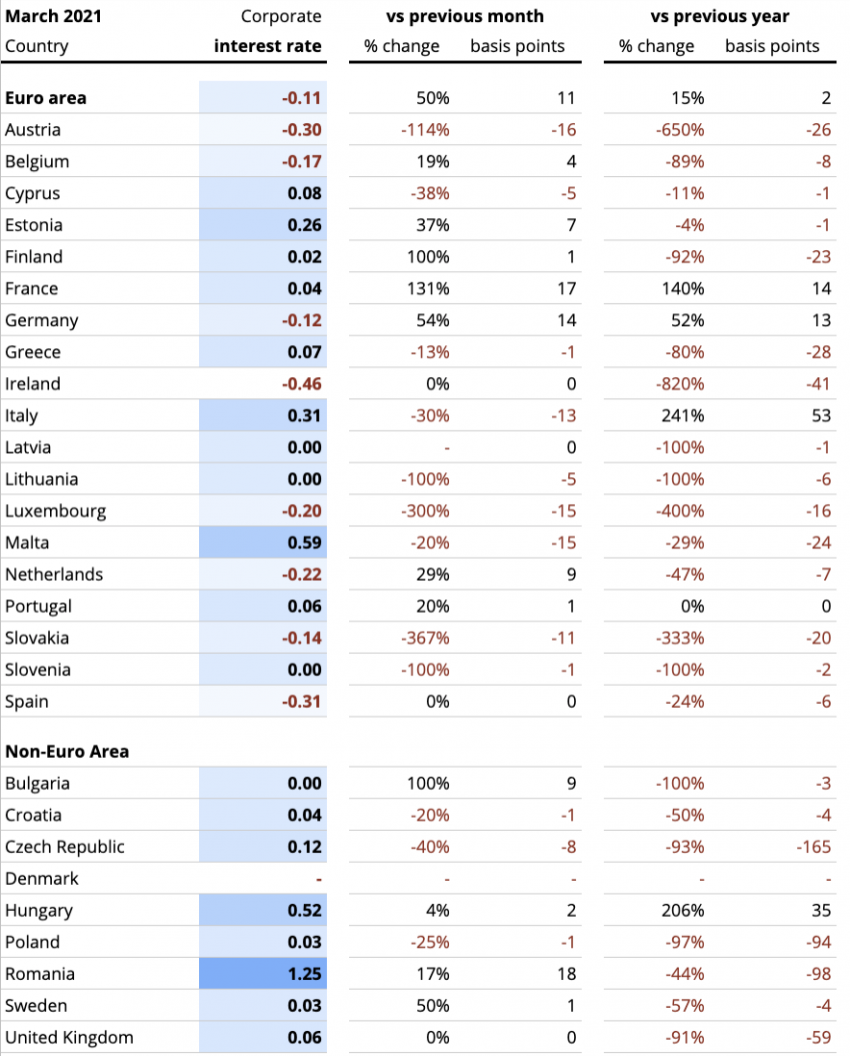

ECB Data: Corporate Interest Rates

Adding to the pressure of increasing inflation, corporates in 22 European countries are facing interest rates on average under 0.1% on their cash. The Eurozone’s average interest rate for businesses is down to 0.18%. Businesses in Germany, Spain, and the Netherlands are particularly hard hit, with average rates between -0.23% and -0.29%, and in Ireland at the bottom with a punishing -0.43% average on corporate deposits.

Corporate rates

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

- Businesses in 10 European countries are facing negative rates on their deposits, including Germany, Austria, the Netherlands, Ireland, and Spain.

- Another 12 markets – France, the UK, and Sweden among them – have average rates for corporates of under 0.1%.

- Of the Western European economies only Italy has a competitive average rate at 0.31%. Estonia along with several Eastern European markets also offer businesses on average a return on their cash.

- Rates near or below zero challenge businesses with stark penalties for holding cash in the face of rising inflation.

Comment by Matthias Klaubert, Raisin Head of Partner Bank Management and Operations

Matthias Klaubert (c) Lukas Schramm

“Banks are facing a unique set of liquidity management challenges in 2021 coming out of the pandemic, knowing customer spending is coming back, but with uncertainty on when and to what extent. The sharp rise in inflation over the last few months also highlights the pressure on banking customers – retail and corporate alike – to find solutions that reduce their losses, if not offer profitability. In several major Eurozone markets the largest banks are increasingly imposing negative rates on business customers, and even lowering the negative rate threshold for retail customers. This increases the pressure on customers to act now. In Germany, the Netherlands, and Spain according to our research, many big banks are so over-liquid that they no longer offer their customers the most popular 1-year fixed-term deposit products at all.

At the same time, we see enormous dynamism in certain sectors of the economy, for instance, but not limited to, the tech sector during the pandemic, and a strong B2B banking market to serve those sectors on the backend. Specialized banks participating in this growth need ever more of that liquidity – much of which is stuck at Europe’s biggest banks – and the specialized banks’ margins enable them to compete on rate to attract the cash they need.

Given the threat of inflation (even if it appears to have been overstated), depositors are eager for savings options that help them mitigate their money’s potential loss in value. The sustained low interest rate environment makes it easier for banks in need of liquidity to stand out to such customers – and surveying European markets they have very cost-effective options in places like Germany, the Netherlands, and Spain.”

*https://www.handelsblatt.com/finanzen/banken-versicherungen/banken/bgh-urteil-deutschebankrechnet-mit-300-millionen-euro-belastungen/27273148.html

Notes: Some of the selected big banks do neither offer a one-year term deposit nor an account with an interest bonus after 365 days without withdrawal. Their interest rate is set 0.0% for the calculation to represent the lack of an offer in the average.

In markets where we have only found two offers for 3-year term deposits, in total, the average is calculated with just those two values.

Sources

Raisin, ECB

Austria: Erste Bank, Raiffeisenlandesbank Oberösterreich, Bawag – sparzinsen-vergleich.at/

Belgium: ING Belgium, KBC, Belfius Bank – spaargids.be

France: BNP Paribas, Credit Mutuel, Societe Generale – francetransactions

Germany: Deutsche Bank, Commerzbank, HypoVereinsbank – biallo.de

Ireland: Bank of Ireland, Allied Irish Banks, Ulster Bank – ccpc.ie

Italy: UniCredit, Banca Monte dei Paschi di Siena, Mediobanca – confrontaconti.it

Netherlands: RaboBank, ING, ABN – geld.nl, spaarrente.nl

Norway: DNB, Danske, Nordea – finansportalen.no

Poland: PKO Bank Polski, Bank Pekao, mBank – oprocentowanie.pl

Portugal: Novo Banco, BPI, BCP – comparaja.pt

Spain: Santander, BBVA, Caixabank – tucapital.es

Sweden: Nordea, SEB, Svenska Handelsbanken – finansportalen.se

United Kingdom: HSBC, Barclays, RBS – which.co.uk

The end of saving? Europeans trapped between rising inflation and decreasing interest rates

Interest rates across Europe have not yet hit their lowest point, continuing to slip fractionally month by month (year by year). The trend has been exacerbated by the pandemic’s economic impact, as we noted last month. As Europeans sit on their savings (some still anxious about the economy or unevenly employed), banks are also hesitating to increase loan activity, meaning ever larger piles of excess cash on their balance sheets. These are among the chief drivers keeping interest rates low, in spite of the European Central Bank’s stimulus efforts.

At best, consumers can look to mitigate the effects of higher inflation by putting their cash in short- to mid-term fixed-rate deposit vehicles. Current inflation numbers – expected to rise further through the year – range from 0.79% (Italy) to 1.24% (France), 1.88% (Netherlands), and ca. 2% (Germany and Spain) across the largest EU markets.

The long view: Many years of low-rate policy have not succeeded in providing the necessary stimulus, so the ECB is debating whether an increase in the inflation target could help drive interest rates back upward.

- Top available interest on deposits changed in Austria, France, Italy, Sweden, Norway and the UK, with increases only in the UK of more than a tenth of a point.

- France, Italy, Norway, and Sweden all saw the average of their highest interest rates decline.

- Rates were stagnant in Germany, Spain, Belgium, the Netherlands, and Ireland.

- Seven of the markets we analyse have spreads between highest rates and lowest (i.e. big banks’ rates) of more than half a point, including Germany, the UK, and Spain.

Top 1-year versus top 3-year deposit rates in European countries

The spread between top 1- and 3-year fixed-term deposit rates remains narrow, under a tenth of a point in Germany and Ireland, and under three tenths in Spain, the Netherlands, the UK, Austria, Poland, and Norway.

France and Italy are among the outliers, with 3-year top rates on average over four tenths of a percent higher than 1-year top rates.

- In the UK and top 3-year interest rates also increased slightly, along with top 1-year rates – in the UK under one tenth.

- France’s top 3-year rate joined the decreasing 1-year top rates: the average of the highest French 3-year deposit offers fell just over one tenth of a percent from last month.

- Germany’s top 3-year interest rate average also slipped but only fractionally.

ECB Data: Retail Interest Rates

The trend across Europe was, again, downward for interest rates. On average, fixed term interest rates on deposits with terms of one year or less fell across the Euro Area, reflecting only slight shifts, however, in already-low rates. Since the start of 2021 not one Eurozone country has seen an average rate over one percent.

Retail Rates

Average interest rate for new deposits, private households; maturities ≤ 1 year, ECB data. Note: The Dutch Central Bank time-series for deposits with maturities up to one year includes a country-specific “construction depot” with higher average rates than overnight and term deposits.

- Of the largest European countries, France and Sweden lost the most ground on average, with France down -12 basis points and Sweden -8.

- Smaller markets of Slovakia and Latvia also reflected losses, with Latvia’s average rate down -16 basis points and Slovakia’s falling -10.

- The only notable upward movement in the latest ECB data was in Luxembourg and Denmark, which are typically volatile relative to the rest of Europe – but only because the numbers reflect every little movement at the fewer banks in those two markets.

ECB Data: Corporate Interest Rates

Corporates may be feeling the good news from the European Central Bank in the shape of small increases in interest rates on business deposits in some of the largest Euro markets, including Germany, France, Belgium, and the Netherlands.

France, notably, escaped negative rate territory with at least a temporary respite for French businesses.

Corporate rates

Average interest rate for new deposits, corporates, maturities ≤ 1 year, Euro Area Statistics.

- Germany and the Netherlands are still in negative territory, but now much closer to zero than last month at -0.12% and -0.22% respectively – up from recent lows of -0.42% and -0.43% in February.

- France gained ground to reach above zero, up 17 basis points to 0.04% on average.

- Business deposit rates in Spain remain under water at -0.31%, unchanged from last month.

- Corporates in Ireland are seeing the lowest interest rates in the Eurozone, with an average of -0.46% on Irish business deposits.

Raisin VP Strategy and Business Development Verena Thaler explains the impact of current low interest rates on consumers and their wealth management options:

“We are entering a new era for wealth building. There are entirely novel challenges for consumers to build their wealth or to diversify their money in short term investments. Most Europeans with savings in the bank face ever lower or even negative interest rates. Now, with inflation rising above the highest interest rates, their ability to earn a yield from their savings has all but disappeared.