How Raisin.ie works

Register once and start investing from the comfort of your home

Open an account in three easy steps

Open a Raisin Account

Finish your registration and complete video identification.

Log in

Once we have verified your identity, we will send you your login details for the Online Banking System. From there, you will have access to exclusive offers from our partner banks across Europe.

Start saving

Select your preferred deposit account and transfer the required investment amount – Raisin.ie will take care of the rest for you. The best part: You only have to verify your identity once!

With Raisin.ie, you decide where in Europe you would like to invest your money. Your deposits are 100% protected up to amounts of €100,000 per customer and bank. More

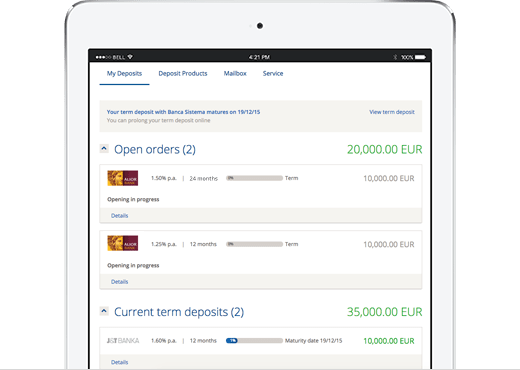

Register once, transfer the funds to your free Raisin Account, then open and manage your term deposits with our partner banks through a single Online Banking System.

Advantages of using Raisin.ie

Easy and convenient

Our marketplace puts savings products featuring attractive rates from a range of partner banks at your fingertips.

Secure up to EUR 100,000

All savings products on Raisin.ie are protected up to an equivalent of EUR 100,000 per depositor and bank according to EU laws. More details

Competitive interest rates

Our marketplace puts savings products featuring attractive rates from a range of partner banks at your fingertips.

Top rates from across Europe

We find the best rates for you. Select from 51 offers from banks across Europe.

With our Online Banking System, you will be provided with an overview of your various deposit accounts as well as regular updates about new savings products, making it quick and simple to open further deposits or prolong existing ones.