Guilty pleasures, hidden fees and forgotten subscriptions cost Ireland €17 billion every year — but austerity measures aren’t the only way to cut costs.

It’s not an easy time for many people in Ireland right now. Due to rising costs for food and energy, people are feeling the squeeze. But new analysis by Raisin Bank has highlighted 23 avoidable expenses that add up to a big burden on household expenditure, where a daily cost of €27 per household turns into over €9,873 down the drain every year.

Typical financial advice often advises people to avoid takeaways, coffees and other ‘unessential’ (but, let’s face it, enjoyable) expenses. And while alcohol and tobacco cost the average person in Ireland €1,739 a year, we believe in a mindset of mindfulness rather than misery. Just a few strategic changes can help Irish households hang on to more of their cash.

From food waste and forgotten subscription fees to phantom energy, here are the expenses households should consider cutting back on.

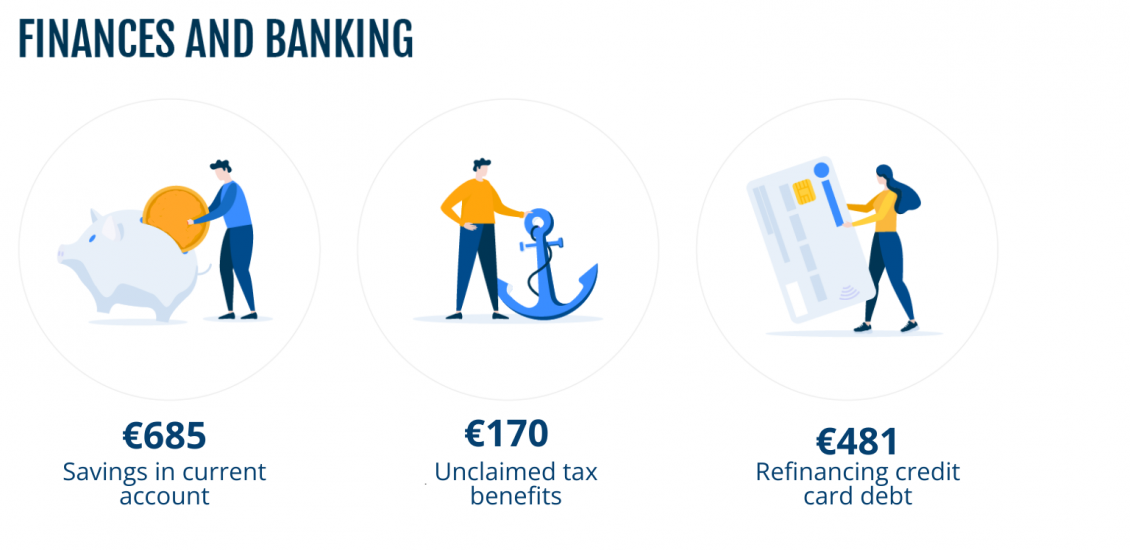

It starts with finances, of course: data shows that Irish households could save €481 a year by refinancing their credit card debt with a personal loan. Meanwhile, last year Revenue confirmed that a whopping €313m was owed to around 481,000 taxpayers who paid too much tax, or failed to claim a tax credit they were entitled to, in 2023.

For the households who have savings, keeping your money in a low or zero-paying account is also money down the drain. Households with €10,000 of savings in a low-yield high-street saving account could pocket an extra €317 by moving this to a more competitive demand deposit account. Alternatively, if you can afford to lock your money away for a longer period of time, you could earn an extra €368 a year by moving your savings to a higher-yield 1 year deposit account.

We’re all guilty of spending on items or experiences that don’t feel too expensive on their own, until they all add up together. Unsurprisingly, one of the worst culprits for money down the drain is alcohol – we calculate that every year, the average Irish household spends €3,017 on alcohol, plus another €619 on online gambling.

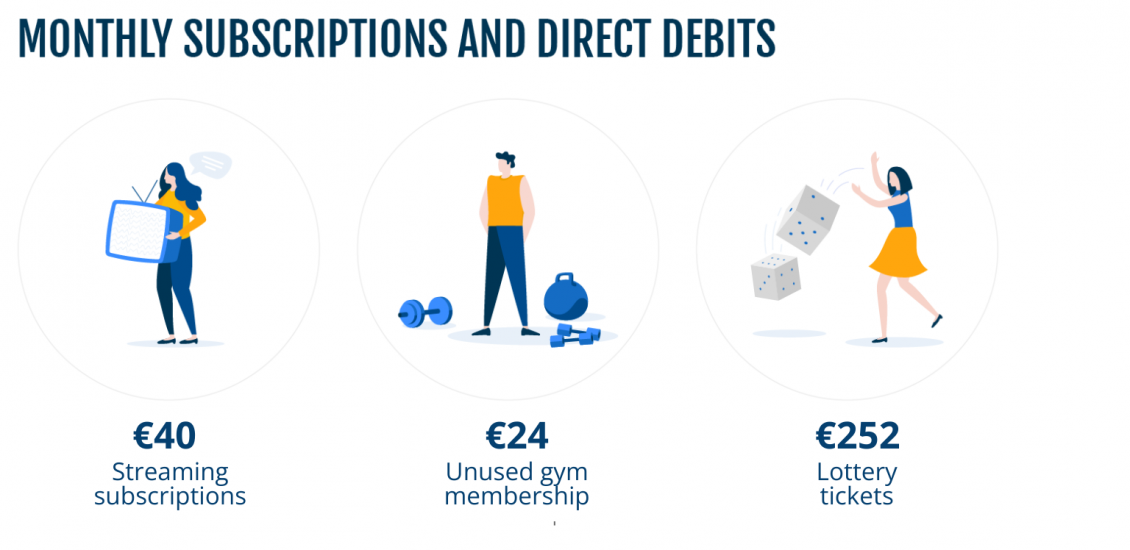

Not shopping around is also a sure fire way to spend extra money – the average household could reduce their electricity and gas contracts by €536 by looking around for better deals, while streaming subscriptions add another annual cost of €40 a year, making it worth checking whether you really are getting use out of all of them, and whether you could switch to family plans to save some extra cash. Feeling lucky? We also calculate that every year, Irish people spend €252 on lottery tickets – well, you do have to be in it to win it!

Looking closer to home, creating a food plan for the week ahead in order to reduce waste could also save you a significant chunk – it’s estimated that domestic food waste added up to €1.29bn in Ireland last year, or €700 per household. Our data also shows that households spend an average of €233 a year on bottled water, meaning investing in a refillable water bottle could be kinder on both your pocket and the planet. Finally, don’t forget to switch those plug sockets off and avoid standby mode – €50 a year goes down the drain from so-called ‘vampire devices’.

Monica Pina Alzugaray of Raisin Bank advises people to cut down, rather than cut out, when it comes to spending: “The ongoing high cost of living presents us with a tough balancing act, however, cutting out all of the items and experiences that we enjoy is likely to be unsustainable in the long run. The Raisin Bank research shows that by taking 30 minutes to review our finances, we can easily identify areas where we could spend a little smarter, look for better deals, or reduce expenditure on things we don’t use or need. Hopefully this means we can still maintain some enjoyment by putting a bit more money back into our pockets.”

—

Methodology

Census data

Total number of Irish households

The most-recent total number of Irish households, as reported in the Irish Census of 2022, is 1,841,152.

Total number of Irish (young) adults (15 and over)

Raisin Bank used the detailed dataset of the Irish Census of 2022 enumerated by age group. The number of Irish (young) adults aged 15 and over is given at 4,136,852.

Financials

Bank account charges

Money Guide Ireland performed a detailed comparison of typical bank account charges for adults, using figures from the four major financial services providers. The following charges were determined: Bank of Ireland €96; Credit Union €72; AIB €151.80; AN Post €117.60. Averaging the four providers puts the average charge per adult at €109.35. With zero-fee and low-fee accounts available and offered by non-traditional providers such as Revolut and N26, total savings of up to €452 million are possible.

Loss of interest

At the end of 2023, Irish households had a total of €152b in total savings. This equates to roughly €82,500 per household. The assumption was made that an average Irish household can deposit €10,000 into a call money savings account, with an additional €10,000 in a short or longer-term deposit facility. With the current average return on savings given at 0.11% AER by Money Sherpa, Irish savers could benefit from an average rate of 3.167% AER on the top-3 offers available. The average rate of the top-3 deposit accounts equals 3.683% AER. This amounts to total added interest of €317 on the savings account, and €368 on a deposit account. Taken as a whole, Irish savers miss out on €1.26b a year.

Tax returns and benefits

In February 2023, the Irish Independent reported Revenue figures confirming that the Irish population missed out on a whopping €313m, spread out over nearly half a million taxpayers, in both excessive tax and because of unsubmitted tax returns. This works out as roughly €170 per average household.

Unclaimed pensions

The National Pension Helpline states that there is an estimated € 400m in pensions that go unclaimed in Ireland. Assuming an average payout period of 20 years, this works out at € 20m a year that lies dormant on unclaimed accounts.

Refinancing credit card debt

Credit cards offer great convenience, but at an equally great cost. The overdraft rates on credit cards are a multitude of those on personal loans. In 2023, the RTE reports that the “average credit card debt for every Irish adult [amounts to] €1,330 each. With the Bank of Ireland APR at 22.1%, and other providers at roughly the same figure, there lies massive savings potential in refinancing this debt at the best available rate for a personal loan, at 5.99%. Total Irish savings come in at a whopping € 886m.

Lifestyle and health

Unused gym memberships

Industry researcher IBIS World puts the total value of the Irish gym and fitness centre memberships sector at € 177.2m. With conservative estimates based on comparable countries placing the rate of non-gym-goers with a subscription at roughly one in four, this leaves us with potential savings of €44m, or around €24 per household per year.

Alcohol consumption

Like most developed countries, the Irish love a drink. The market for alcoholic beverages is estimated by an Alcohol Ireland report to amount to €5.56 billion in 2023, or €1,343 per Irish (young) adult.

Tobacco

Smoking is an unhealthy habit. Revenues in Ireland remain high, with market researchers putting the tobacco market size at €1.64b in 2021, and ‘healthy’ market growth figures of 3% year over year expected in the coming period. Interestingly, according to the 2022 Census, less than one in ten Irish adults indicated that they smoke daily. Moreover, three in four Irish people support a complete phase-out of tobacco. Maybe it’s time to definitely kick the habit, and pocket an additional €891 a year per household in the process.

Lotteries

In moderation, lotteries can be great fun. According to the 2021 National Lottery report, for every euro spent, roughly 56 cents are paid out in the form of winnings. An additional 29 cents are paid out in the form of contributions to good causes. Nevertheless, with total sales of €1.05b, we could still save roughly €252 per Irish household a year in playing losses.

Gambling

Statista market research projects the Irish online gambling market to reach revenues (stakes minus payouts) of € 1.14b in 2024. These are Gross Gambling Revenues (GGR), i.e. the total amount of bets placed by customers minus the amount paid out in winnings. This equals a whopping € 619 in per Irish household per year.

Food and power waste

Food waste

Food waste is a pressing issue in virtually all developed nations. The Environmental Protection Agency published statistics and estimates that “Ireland generated 753,000 tonnes […] of food waste in 2021”. As the biggest producers of food waste, households are responsible for 29% of this. The EPA concludes that: “Food waste costs the average Irish household about €60 per month or €700 per year. That’s an annual national cost of €1.29 billion.” To make matters worse, Irish households are some of the “biggest wasters” in the EU, as reported by Eurostat.

Power waste/vampire devices

Back in 2022, the Irish Independent quoted an expert who estimated that the average Irish household can save roughly €50 a year by both eliminating power waste through vampire devices and by making more conscious decisions. At the national level, this would add up to a whopping €92 million in savings.

Bottled water

Irish tap water is universally free of contamination, as reported by the EPA. Bottled water is a luxury many Irish households afford themselves, but a recent study casts significant doubt on any perceived health benefits of bottled water, with massive quantities of potentially harmful nanoplastics found in bottled water samples. Statista puts the annual revenues of bottled water in Ireland at €430m a year. If we bottle our habit, we can save €233 per household each year.

Switching contracts, plans, and subscriptions

Switching electricity & gas contracts

According to comparison platform Switcher.ie, a typical Irish household can expect to save €536 if they switch to a cheaper tariff and make use of one of many introductory discounts available. With loyalty to existing contracts high in Ireland, this can add up to €987m on a national scale.

Switching mobile plans

Many Irish opt for a mobile plan with a phone. And although this might look like a good deal, monthly rates usually go at roughly €40 to €60 a month. SIM only plans do not come with the latest phone, but are already available at a cost of just €15 to €20. This results in potential average savings of up to €40 per person per month, or €165m in total for the country at large.

Switching other services

In October of 2022, business financing firm Capitalflow carried out a research into switching habits and potential savings. In the report, the following potential annual savings were indicated, as cited by survey participants:

- Switching mortgage providers: €1,094.30

- Switching digital TV providers: €107.54

- Switching broadband providers: €124.07

- Switching health insurance providers: €214.31

- Switching car insurance providers: €162.57

- Switching home insurance providers: €125.37

Taken together, this adds up to a whopping €1,800 per household per year, or €150 per month. The potential nationwide savings amount to €3.36b.

United States

United States

Germany

Germany

Spain

Spain

United Kingdom

United Kingdom

Netherlands

Netherlands

Austria

Austria

France

France

Ireland

Ireland

Poland

Poland

Other (EU)

Other (EU)