Many banks in Italy are profitable. Information on deposit protection, rating agency ratings and the country’s economic growth also illustrate why an attractively priced investment in Italy can make sense.

Why should I invest my money in Italy? – The answer is simple: Italy has considerably higher interest rates than Ireland, offered by profitable banks. And thanks to the deposit insurance, they are covered for savers.

Profitable banks in Italy

Raisin.ie selects each partner bank on the platform according to strict criteria. We do not list any offers, in which we would not invest ourselves. The Italian bank Banca Farmafactoring, for example, is one of the most profitable banks in Europe in terms of return on equity (RoE*) of 34%. A positive value means that the bank is profitable, the higher the value, the better for the bank. Savers receive an attractive interest rate from BFF for fixed-term deposits with maturities ranging from 3 months to 3 years.

Deposit protection in Europe

Sound financial institutions are important. But the safety net behind it also calms the nerves of savers: all savings deposits up to an amount of 100,000 euros including interest income are legally protected at 100% per customer and per bank by the Italian Deposit Protection Fund. This protection naturally also applies to investors from Germany. The European Banking Supervision Authority (EBA) writes in this regard:

“This amount is guaranteed irrespective of the current level of available funds under a Deposit Guarantee Scheme (DGS). All Member States extend this guarantee to their savers. The level of available financial resources of a Deposit Guarantee Scheme does not affect the level of this guarantee and, in any case, alternative financing options are available for the guarantee.”

This statement reduces the risk for savers to zero. In addition, Member States are required to hold at least 0.8% of their deposits in cash. They have until 2024 to do this, and each year they pay into the guarantee schemes.

Deposit Protection Fund in Italy

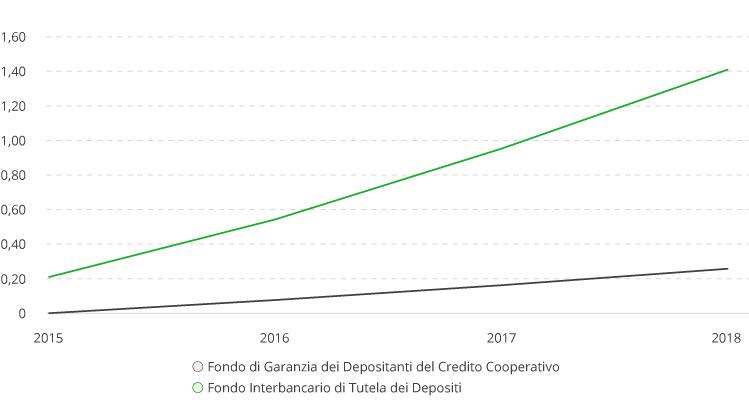

The Italian deposit guarantee scheme consists of two funds. Both must hold at least 0.8% of all Italian deposits. Italian banks pay into the Deposit Guarantee Scheme year after year (see graph):

Country rating

The rating agency Standard & Poor’s gives Italy a rating of BBB. This corresponds to an average investment grade. In general, the rating by the rating agency of sovereign wealth funds, pension funds and other investors is used to assess Italy’s creditworthiness and has an impact on the country’s credit costs. For savers, the country rating is also a crucial factor for investment.

Economic growth

Italy is among the 10 largest economies in the world (8th place) and the economy grew by 0.1 percent in the second quarter of 2019, as in Germany, thus exceeding expectations, reports the news agency Reuters. On an annual basis, growth amounted to 0.3 percent. Italy’s government expects the economy to grow again by around 0.4% in 2020.

Debt

The Italian government is working on a budget for 2020 that is fully in line with the rules of the European Union. With this, Italy wants to boost the weakening growth and contain the budget deficit. According to EU convergence criteria, government debt should not exceed 60% of GDP. In 2018, the country still had a national debt of 134.80 percent of gross domestic product. By way of comparison, the US has a national debt of 106 % and Japan even more than 200 %. Nevertheless, both countries are considered safe havens for investment.

Conclusion

Despite weakening economic growth and an increased level of debt, savings deposits in Italy are hedged. This is ensured not only by the two deposit guarantee funds, which increase their available funds year after year, but also by the guarantee of the European Banking Supervision: 100,000 euros are covered per saver and per bank, “regardless of the current level of available funds in the deposit guarantee system”. Last but not least, it is profitable credit institutions that offer attractive interest rates via the interest rate platform Raisin.ie.

*RoE: The return on equity is calculated by taking profit divided by the owner’s equity. The profit is defined as the profit for the financial year and the equity is defined as the book value of equity at the beginning of the financial year. This ratio can be an important indicator for savers who want to opt for an interest rate product in Italy. The data comes from the banks and is publicly available.

United States

United States

Germany

Germany

Spain

Spain

United Kingdom

United Kingdom

Netherlands

Netherlands

Austria

Austria

France

France

Ireland

Ireland

Poland

Poland

Other (EU)

Other (EU)