What you need to know about gifting money in Ireland

In Ireland, gifting money to your loved ones is pretty easy, but it’s important to bear in mind that some gifts might be taxed by the government as a type of Capital Acquisitions Tax (CAT). On this page, you’ll learn everything you need to know about gift tax, including your gift allowance and gifting exclusions.

Gift tax is a type of government tax paid by someone who gives away something worth over a certain limit, such as money or property

Gift tax prevents Irish citizens from avoiding inheritance tax by giving away their money or possessions before they die

Every Irish citizen is entitled to an annual gift allowance of up to €3,000 per calendar year

The amount of tax you have to pay depends on your relationship to the person you’re giving the gift to

What is gift tax?

In Ireland, gift tax is applied when you give something of value to someone. Gift tax is designed to prevent Irish citizens from avoiding inheritance tax by giving away your money as gifts before you die.

What counts as a gift?

A gift can be anything you give that has value, such as money, possessions, and property. It can also be something that has decreased in value. For example, if you sell your house for less than its actual value to your child, the difference in value can count as a gift.

Are all gifts taxable?

Not all gifts are taxable, and there are certain types of gifts that are exempt from gift tax. However, this depends on whom the gift goes to and how much money the gift is worth.

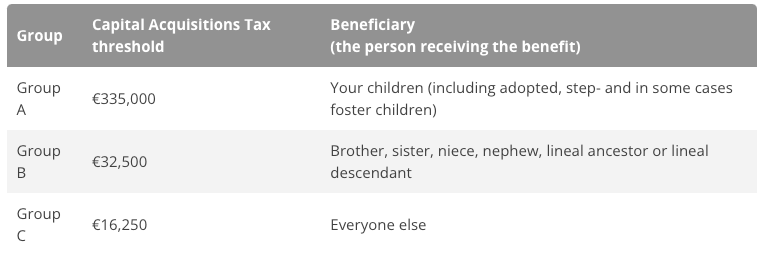

There are three group thresholds in Ireland. The amount of tax you may have to pay depends on your relationship to the beneficiary and which group they’re in. The groups are as follows:

Charities, trusts and national organisations can also be considered exempt beneficiaries, so any gift made to them will not be subject to tax.

There’s no limit on gifts made to exempt beneficiaries, but if you want to make a gift to someone who is not an exempt beneficiary, you have an annual tax-free allowance of up to €3,000 per person.

How much is the annual gift allowance?

You’re entitled to an annual tax-free gift allowance of €3,000. This is also known as your annual exemption. With your annual gift allowance, you can give away assets or money up to a total of €3,000 without them being added to the value of your estate. Once you’ve exceeded this allowance, the gifts you give may be subject to inheritance tax in the event of your death.

If you don’t use your full gift allowance in one year, you’re allowed to roll it over to the following year. You’re only allowed to do this once, so you couldn’t roll any allowance you haven’t used over for a second year.

Are there any gift tax exclusions?

Yes, some gifts are exempt from gift tax. Some of the types of gifts that are excluded from gift tax in Ireland include the following:

‘Everyday’ gifts that you take out of your income to give as Christmas or birthday presents, or, in some instances, when you gift money to your children. In order to remain exempt, once you’ve given the gift, you must still be able to maintain your usual standard of living.

Any gift you give to your spouse or civil partner, including inheritance

Payments that are aimed at helping another person’s living costs can also be exempt from gift tax. The recipient of this type of gift might be an elderly relative or a child who’s under the age of 18.

Lottery, sweepstake or betting winnings.

Charitable donations and gifts to institutions such as art galleries, museums and heritage funds are also exempt from gift tax.

Does it matter when you give a gift?

Yes, the timing of your gift matters. You can only gift up to €3,000 per calendar year to one person. If you gift over that amount, you’ll be liable for Capital Acquisitions Tax at a rate of 33%.