Everything you need to know about pension relief

When you’re saving for retirement, it’s important to get the most out of your money, and pension tax relief can help you do just that. With pension tax relief, some of the money you would have paid to the government from your net pay in Social Insurance contributions goes into your pension instead. On this page, you’ll find out everything you need to know about pension tax relief and how to claim it.

What is pension tax relief?

If you’re earning pension tax relief, it means that some of the money you would have paid in income tax goes into your pension instead of being paid to the government. The amount is based on your income tax bracket, meaning that if you’re a higher rate taxpayer, you can claim 40% in pension tax relief.

When you save money into a pension, the government provides bonuses as a way of rewarding you for saving for your retirement. As you put money into your pension, the money you were supposed to pay as tax on your earnings goes to your pension instead.

How does pension tax relief work?

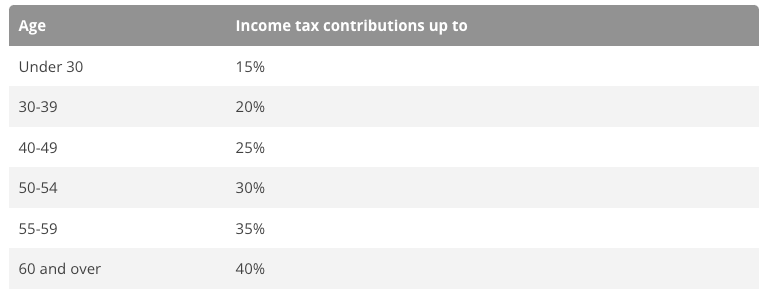

In Ireland, pension tax relief is based on your contributions at the highest rate of income tax that you pay. This means that the pension tax relief you’ll receive will depend on the tax band you’re in. Tax bands depend on your age, as follows:

There is also an annual limit when it comes to tax relief. This limit takes into account the maximum percentage of your income (depending on your age), and a limit on the amount of income when calculating the percentage. The maximum earnings taken into consideration when calculating your tax relief is an annual amount of €115,000.

Am I eligible for pension tax relief?

If you’re an Irish citizen under the age of 75, you live in Ireland and pay into a pension, you’re eligible to claim pension tax relief. You’re still eligible to claim if you’re a non-taxpayer and aren’t in employment, for example if you’re a full-time parent or low-income earner.

You’ll also be eligible for pension tax relief if someone else pays into your pension, but you won’t be eligible if your pension scheme automatically claims tax relief on your behalf. Find out if you’re eligible for pension tax relief by contacting your pension provider.

How do I claim tax relief on my pension contributions?

How you go about claiming tax relief depends on the type of pension you’re saving into. You can find the specific details by looking at your individual scheme, as sometimes you may need to do some of the legwork. The two main ways of claiming pension tax relief are as follows:

Get pension tax relief from your net pay as a PAYE worker. This type of pension scheme deducts contributions directly from your salary before you pay income tax. Your pension provider will then automatically claim the tax relief based on your highest rate of income tax on your behalf.

If you are self-employed, you need to sign in to the Revenue Online Service (ROS) to claim your pension tax relief.

Higher tax-rate payers need to complete a self-assessment tax return to claim tax relief. Remember that you’ll need to submit your tax return before the deadline to avoid any penalties.

There’s a useful video on the Revenue website which explains in detail how to calculate your pension relief and how to complete Form 11, which is your claim form. You can watch the video here.

How much can I pay into a pension and still get tax relief?

As well as the annual limit (see above), there is also a limit on the amount you can pay into your pension and still claim tax relief. This limit is known as the Standard Fund Threshold, and is currently €2 million.

If you have more than €2 million in your pension pot, you’ll be taxed 40% on the amount you’re over this limit when you withdraw the excess.

Grow your savings as you get tax relief on your pension

It’s important to start saving for retirement as early as possible, and it might be worth considering different types of savings accounts as well as paying into a pension.

If you want to quickly and easily open savings accounts from a range of banks, register for a free Raisin Bank Account and apply for savings accounts online today. There’s no need to fill out a new application each time you apply, and your money is deposit protected from the moment it arrives in your Raisin Bank Account through to when it automatically transfers to and from a partner bank.