Income tax explained

Income tax is a form of tax that Irish taxpayers pay the government on their income. You’re not only taxed on your personal income, but you might also be taxed on other income sources such as dividends and interest from savings over a certain amount. On this page, you’ll learn what income tax is, how it’s calculated and what the income tax rates are in Ireland.

Income tax applies to most types of income, and is the Irish Government's main source of revenue

It is made up of two different tax rate bands - 20% and 40%

You can reduce the amount of income tax you have to pay if you're eligible for tax credits

What is income tax?

Income tax (IT) is the tax you have to pay the government based on your yearly income. If you’re self-employed, you’ll pay taxes on any profit you make. This includes income from products and services that you sell online.

What is income tax used for?

Income tax is the government’s main source of revenue and is collected by Irish Tax and Customs on their behalf. The government uses the revenue from income tax to provide funding for public services such as healthcare, education and the welfare system. This revenue is also used for other investments for public use, such as road construction, railways and housing.

Who pays income tax?

Income tax applies to most types of income, including the salary you earn from your job, profit earned from your business, pensions, and even the rent you receive if you’re a landlord. Corporations, estates and other types of entities are also required to pay tax on their profits.

You might not have to pay income tax on all of your income, because most people qualify for one or more types of tax-free allowances or tax credits. An allowance is the amount of taxable income you can earn before paying income tax (more on that below).

How is income tax calculated?

Income tax in Ireland is made up of two different tax rate bands, 20% and 40%. Your income tax will be calculated based on the tax band you’re in, and also on your personal circumstances, such as whether you’re:

- Single

- Married or have a civil partnership

- Widowed or you’re a surviving civil partner

Generally, the more income you earn, the higher your tax band, which means you’ll pay a higher amount of income tax. Income tax bands are designed to make paying tax as fair as possible to everyone, so that those who earn the most, contribute more. This is called a progressive tax.

What are the income tax rates in Ireland?

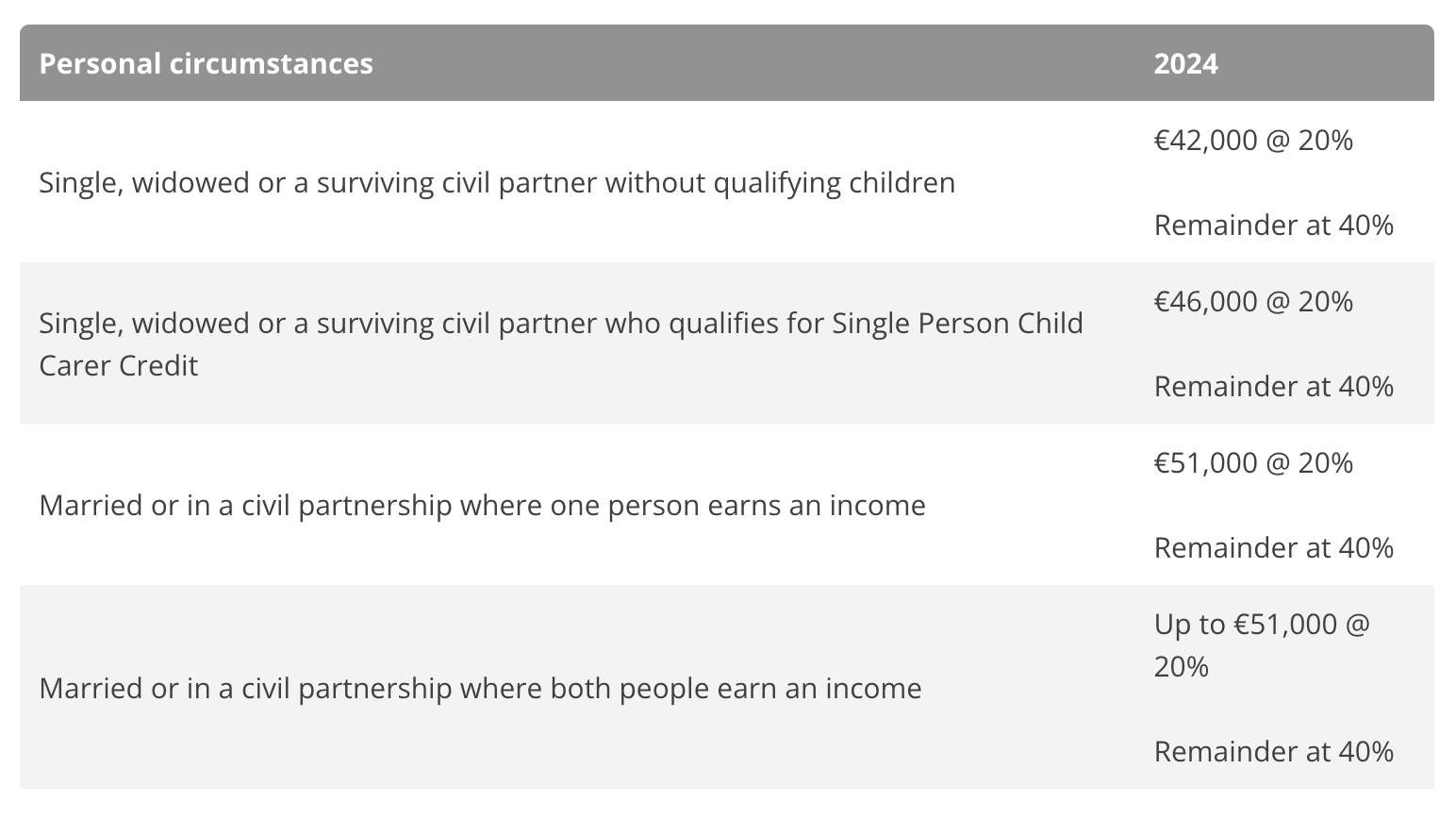

The following table shows the income tax rates in Ireland, which are based on how much you earn in the 2023/24 tax year.

What are tax credits?

Tax credits can reduce the amount of income tax you may have to pay. These are the different types of tax credits you may be eligible for:

- Personal Tax Credit – how much you’ll get depends on whether you’re single, married or in a civil partnership, widowed or a surviving civil partner, separated or divorced

- Additional tax credits, which you may get if you’re:

- A PAYE employee

- A carer

- 65 or above

Have you checked whether you’re due any income tax back? You may be due a tax refund. If so, you might want to think about starting a rainy day savings pot. Raisin Bank offers competitive interest rates on savings accounts from partner banks. Register for a Raisin Bank Account today.

Grow your savings with Raisin Bank

If you want to grow your savings, opening a high-interest savings account could be a good way to invest your money. The good news is you can access a range of competitive savings accounts through Raisin Bank by registering today.